Private equity fundraising remains a highly competitive process in 2023 with asset managers raising less funds compared to last year

As private markets continue to become more appealing to investors, managers looking to provide solutions should ensure their investors fully understand the unique way these private funds are raised and distributed before committing capital

The private equity industry has achieved exponential growth over the last two decades due to the attractive returns on offer for investors, with private credit expected to double over the next few years

To stay ahead of the competition, asset managers should leverage tech to increase investor engagement

Since the turn of the century, the alternative investments industry has experienced exponential growth with private equity becoming a staple of many investors’ portfolios worldwide.

In this edition of Bite Stream Insider, we dive deeper into the world of private markets and alternatives. Why private equity has experienced such rapid growth, the rise of private credit and how new technology solutions are paving the way for a wider pool of investors to capitalize on the historically attractive returns.

Why are private markets so popular and attracting new investors?

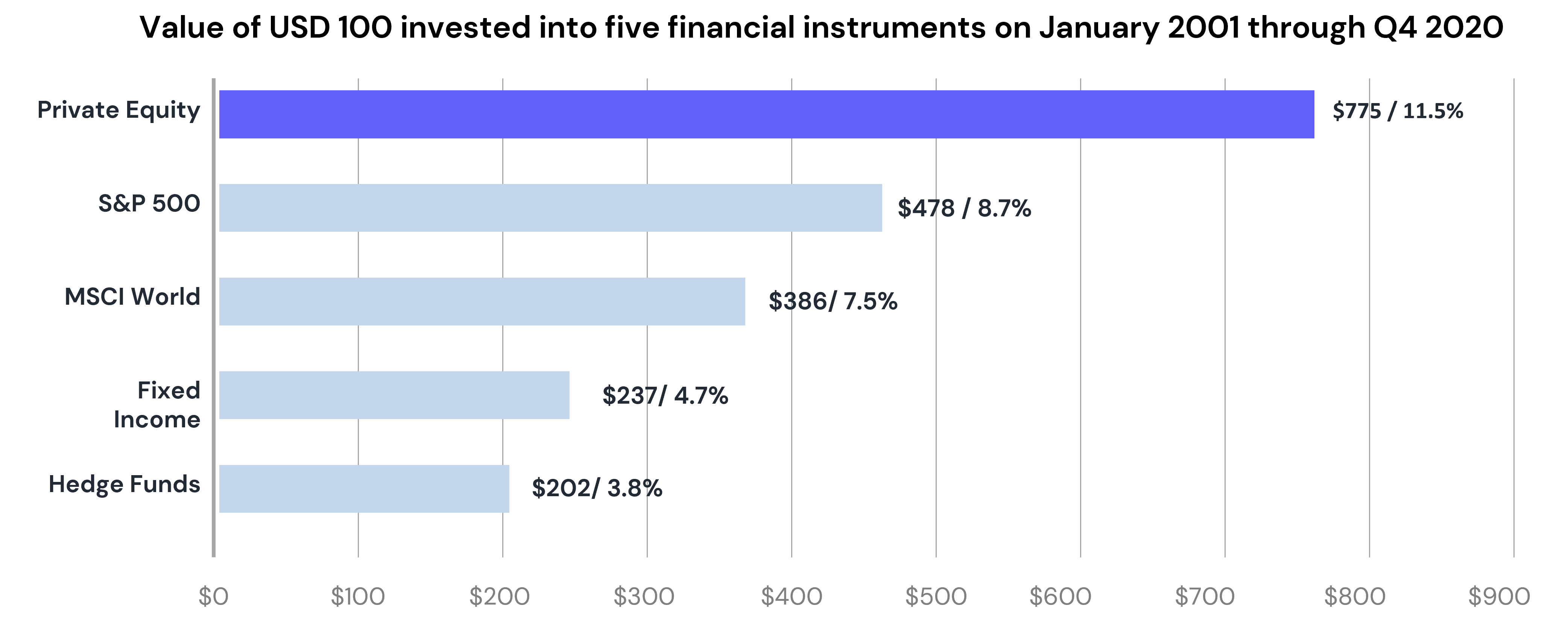

An obvious reason for the rapid growth of private markets is the consistent outperformance of private equity to its public markets equivalents. For example, as illustrated in the below graph if you invested $100 in private equity in 2001, it would now be worth an impressive $775, compared to just $478 if you invested in the S&P500 over the same period.

Figure 1: How global private equity has consistently outperformed various asset classes1

Figure 1: Value of USD 100 invested into five financial instruments on 1 January 2001. Private equity: Burgiss; Fixed income; Barclays US Aggregated Bond index; Hedge funds: HFRI FOF index; both MSCI World and S&P500 represent total return indices. Private Equity data sourced from Burgiss covers vintages 2002-2018,2,209 funds, and USD 2,399 billion in market capitalization. Private equity strategies include: Buyout, VC(Late), VC(Generalist), and Expansion Capital. All dollar figures are USD. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future returns.

However, private equity is not the only strategy which has seen rapid growth. Private credit has catapulted itself into the spotlight over the last decade with assets under management (AUM) estimated to be at approximately USD 1.2 trillion 2.

Fueling this growth, companies are now increasingly likely to choose private lenders over banks to finance debt. A trend we expect to increase with private credit’s AUM set to double by 20263. With flexible private credit strategies to enable investors to adapt to challenging economic climates, this asset class will play an increasingly important role within investors’ private market portfolios and as such the investment products managers will create to attract these investors.

“Recent technological advancements have opened private markets to new types of investors.”

Recent technological advancements have also added to their popularity as they have opened private markets to new types of investors, including High Net Worth Individuals (HNWIs), Family Offices and Wealth Managers. With this shift, it is vital that managers ensure that these types of investors are fully educated on the multitude of differences when investing capital into closed-ended private market funds compared to public equivalents, especially if it is their first time doing so. For example, comprehending the consequences for investors’ liquidity requirements, the J-Curve and the four key stages of the distribution waterfall. Covered in detail here, they are essential for investors to understand so they can plan for liquidity requirements and when they may be able to see a positive return on their initial investments.

Private equity fundraising processes

Once an asset manager (GP) announces the launch of a new fund, this is traditionally an elaborate and time-consuming process. Typically, the back and forth between prospective investors (LPs) and GPs commences, involving everything from undertaking due diligence (on both sides), and understanding complex compliance requirements to potentially negotiating fund documents and terms. This process can take just months or, in most cases (and especially when marketing first-time funds), years.

While private equity has grown exponentially in recent years with new entrants and, as a result, new sources of capital flooding the sector, the fundraising process for asset managers remains an incredibly competitive environment. Even more so amidst the backdrop of today’s challenging economic climate.

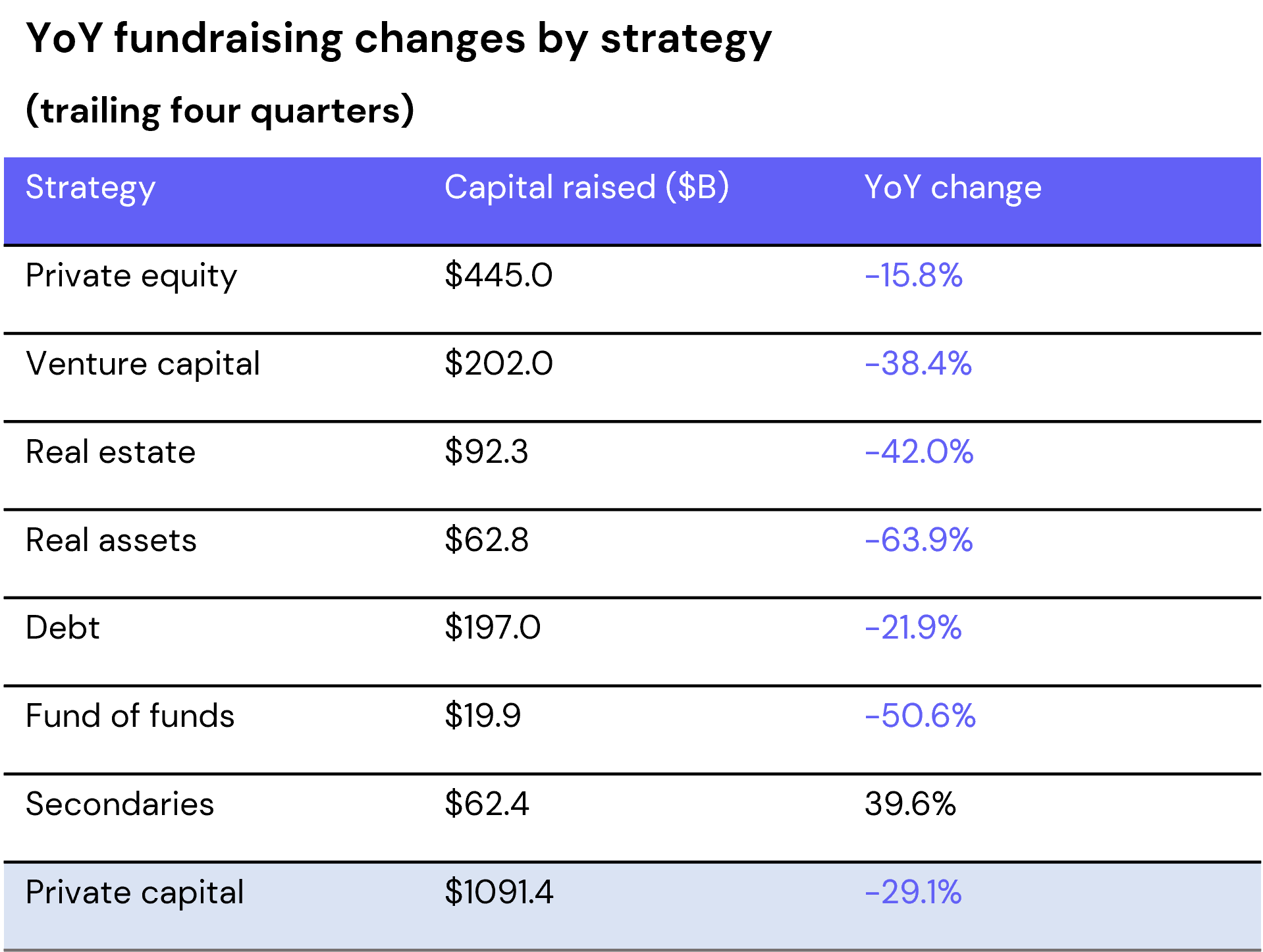

Pitchbook fundraising data from the first quarter of 2023 shows all private markets sectors (with the exception of secondaries) are raising less capital compared to the same quarter of 2022, with the early indications pointing towards another decrease in fundraising levels this year.

Figure 2: Capital raised for almost all private markets sections has seen a precipitous drop4

Source: Pitchbook | Geography: Global | As of 31 March 2023

The ever-increasing popularity of private markets and the unpredictable economic climate of 2023 have combined to create an intensely competitive private equity fundraising sector. This highlights the importance of staying ahead of the competition wherever possible.

New technology supports further growth of private markets

Traditionally, private equity fundraising, including investor onboarding processes, has lagged behind the wider financial industry in terms of digitalization, becoming a barrier to entry for first-time private market investors. With investments going into private markets set to grow at an impressive 12% CAGR, coupled with today’s highly competitive fundraising environment, there is now a huge demand for new technological solutions to change traditional processes. Technology not only allows easier access to private markets for a wider pool of investors, but it also helps streamline traditional, time-consuming processes.

This is why we created Bite Stream, a configurable investor management system, which we believe is the ideal solution to increase efficiency throughout the entire fund lifecycle.

Bite Stream is a multi-jurisdictional, end-to-end solution for fund managers which caters to all types of investors. From fundraising, onboarding, monitoring, and reporting to investor communications and capital calls, our platform supports all asset managers, regardless of their size or geography.

“Bite Stream will help to avoid overly time-consuming and speculative investor roadshows, enabling both investors and fund managers to become more productive and stay ahead of the competition.”

By solving cross-border compliance risks, we drive speed to market while at the same time enhancing and simplifying the investor experience with e-subscription and digital signatures. There is also a built-in CRM system that seamlessly integrates with third-party providers, ensuring total data security.

Quite simply, we know there is an urgent need to adopt technology to increase efficiency and connectivity in the capital-raising processes. Our platform will help to avoid overly time-consuming and speculative investor roadshows, enabling both investors and fund managers to become more productive with their time and stay ahead of the continually expanding number of competitors.

Conclusion

In summary, private markets, and in particular private equity investing, have experienced unprecedented levels of growth over the last two decades, with private credit expected to continue driving the sector growth. As a result, this once-niche asset class is becoming increasingly appealing to investors’ portfolios across the globe. Managers need to ensure they have the right technological tools to support this growth if they are going to educate their investors and market their funds for faster, more efficient fundraising.

Sources:

- Blackrock, On the Historical Outperformance of Private Equity, July 2021

- Preqin, 2022 Preqin Global Private Debt Report, January 2022

- Private Equity Wire, Private Debt AUM Set to double to USD2.69 trillion by 2026, January 2022

- Pitchbook, Global Private Market Fundraising Report, May 2023

Disclaimer: All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, Bite Investments. The facts of this specialised article are believed to be correct at the time of publication but cannot be guaranteed. Please note that the findings, conclusions and recommendations that Bite Investments delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such, Bite Investments can accept no liability whatsoever for actions taken based on any information that may subsequently prove to be incorrect.

This document has been prepared purely for information purposes, and nothing in this report should be construed as an offer, or the solicitation of an offer, to buy or sell any security, product, service or investment.

Learn more about how Bite Stream can help you

Discover a solution that suits your needs