US-headquartered fund managers are seeking to diversify their investor base, with European retail investors high on their list of priorities.

However, complex compliance and regulatory requirements make many US managers reluctant to enter Europe.

Traditional routes to attract European investors can be enhanced by using top of the line fundraising and investor management software

Private markets have seen exponential growth over the last two decades, displaying no signs of abating. Recent estimates suggest private markets could grow by a staggering $8 trillion by 2030 with European wealth managers anticipating private markets investments to account for around 11% of their sector’s AUM[1]. Due to this global growth trend, US-based fund managers are looking to diversify their international investor base, viewing European retail and high net worth (HNW) investors as a significant, yet often untapped, market[2].

“The European challenge - a hard nut to crack”

Europe has traditionally been a hard nut for US managers to crack[3]. The rapid growth of private markets has (rightfully so) brought increased scrutiny, making many US firms hesitant to target the EU market due to complex multi-jurisdiction compliance requirements. While there is an appetite to expand their European investor base, a recent survey found 78% of US-based fund managers believe ESG and new sustainability rules in Europe are more complex than their domestic equivalents, creating a barrier to entry[4].

Despite these challenges, the need to broaden the investment base is becoming more pressing due to a competitive fundraising environment, caused by a slowdown in commitments from US-based institutional investors, equity market volatility and an unpredictable global macro-economic climate. There is ample wealth in Europe. The institutional investor market in Germany has for example grown by 8.4% annually since 2013, and now sits on an asset pile totaling €3.4 trillion[5].

“HNW and UHNW investors in Europe continue to be underexposed to private markets in comparison to institutional peers, this trend is expected to change.”

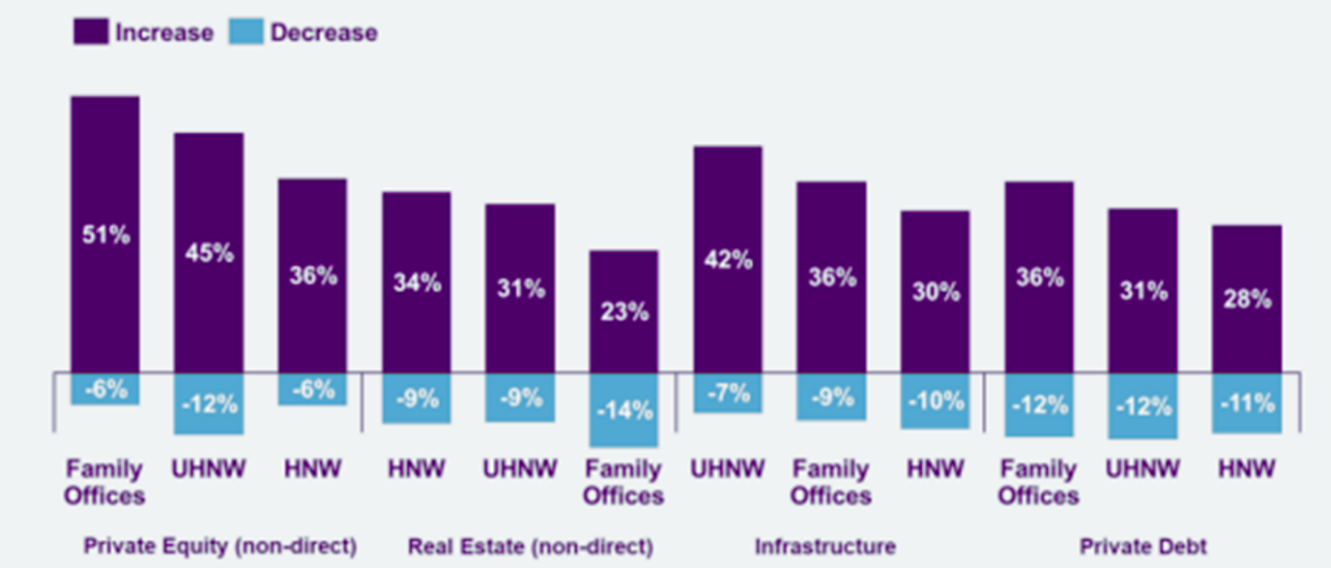

While HNW and ultra-high-net-worth (UHNW) investors in Europe continue to be underexposed to private markets in comparison to their institutional peers, this trend is expected to change. A recent survey (figure 1 below) of private banks and wealth managers showed how there is an expectation that both HNW and UNHWs will significantly increase their allocations to private equity over the next 12 to 24 months.

Figure 1: Anticipated asset allocation changes to private assets over the next 12-24 months by investor type, 2023

Source: Cerulli Associates

“How do US managers find willing investors?”

Technological advancements and new regulations aimed at improving accessibility to private markets (such as the European Long-Term Investment Fund launched earlier this year) have made European retail investors more of a target than ever before[6]. To emphasis this point, we are already seeing US managers structure funds to be more attractive to individual investors based outside of the US[7]. But how do US managers effectively find this willing and expanding investor base?

Firstly, it is important to get on the radar of this investor base. There are numerous high profile private equity events that regularly bring together the main players across the EU private equity scene. These events allow US managers to pitch their strategy and track record directly, and in person to the European investor community. Additionally, industry associations can help raise US managers’ profiles through warm introductions to relevant European wealth managers. Private banks also frequently offer networking events with direct access to potential clients. You can find a list of current industry events and associations in our 2024 planning guide.

Focusing on the UK and Switzerland is a good start, but it is worth attending wealth manager events in France and Germany as well. Different markets often have different strategy preferences when it comes to allocating to private markets, so check Preqin data to understand where to target your fundraising efforts. Tick the above steps and you’re on your way to broadening your investor base over the Atlantic but are you reaching all the HNWs in Europe seeking smaller tickets and, if so, what are the key considerations when trying to onboard these new investor leads?

Another well-trodden route to maximize exposure to your fundraising efforts is to collaborate with wealth management firms, registered investment advisors (RIAs) and, of course, prominent large-scale investment platforms. By building meaningful, long-term relationships with these key stakeholders you ensure future fund offerings are firmly on their radar, gradually building a captive investor audience for your products.

“How to deal with the complex compliance and regulatory requirements?”

Technological advances mean it is possible to attract new investors with innovative, digital software. You can now reach these retail investors looking for smaller tickets compared to the usual institutional players. Investor roadshows can now be done remotely, saving precious time and travel costs in the process.

“Fund administration and the necessary legal support for onboarding new investors add further complexity. Clearly, a streamlined smart technology solution is essential.”

However, with new geographies and investor groups, come new challenges. The most pressing of which is how to deal with the intricate compliance and regulatory constraints. Unlike the US, these can vary significantly across different jurisdictions and countries. Fund administration and the necessary legal support for onboarding new investors add further complexity. Clearly, a streamlined, smart technology solution is essential to successfully navigate these complex requirements.

“Would we need to adapt our marketing strategy?”

While considering the regulatory requirements of a new geography, identifying the right marketing strategy for the target region is a must. Firms must undertake their own regulatory assessments, but there are three marketing avenues which appear to be most actively used by US fund managers to access EU-based investors[8];

- National Private Placement Regimes (NPPRs): This Regime can provide fund managers with the ability to market their funds in certain (but not all) EU member states;

- establishing an AIFM (Alternative Investment Fund Manager) or using a more cost-effective third-party AIFM can help to facilitate the distribution of investment products in Europe, and lastly;

- reverse solicitation which involves investors directly seeking information about a specific fund. However, despite the potential cost and time benefits, reverse solicitation is a narrow term and requires robust consideration of complex regulatory matters.

“Our multijurisdictional platform provides unparalleled access to new (and relevant) investors and markets”

This is where we believe Bite Stream comes into play. Our multijurisdictional platform provides unparalleled access to new (and relevant) investors and markets. The platform is designed to cater to different markets and investors. By utilizing new technology in combination with the creation of varied investment vehicles, smaller investors can now have direct access to your investment products.

Bite Stream offers a secure investment lifecycle from fundraising to post investment reporting, handling associated fund administration with ease, while allowing timely communication regardless of geographic distance via features such as our Wealth Management feature, the GDPR-compliant communications center. We eliminate the need for expensive intermediates as our smart platform can be used exclusively for fundraising, investor management, investor relations and reporting.

If you are looking to diversify your investor base today, then look no further than the Bite Stream platform to help you not only stand out from the crowd but keep on top of all necessary compliance and regulatory requirements that will inevitably come your way!

Sources:

- Carne Group, Atlas 2024 report, July 2024

- JTC, US MANAGERS EYEING EUROPEAN CAPITAL, 23 April 2024

- Citywire Selector, Blackstone determined to attract Europe’s wealthy to private markets, 11 September 2023

- Carne Group, Atlas 2024 report, July 2024

- Universal Investment, What is the scale and opportunity of the German market?, December 2023

- euroclear, ELTIF 2.0 regulation unlocks access to private markets, 10 January 2024

- WealthBriefing, Partners Group Scores Industry First With “Evergreen” ELTIF Structure, 8 May 2024

- JTC, US MANAGERS EYEING EUROPEAN CAPITAL, 23 April 2024

Disclaimer: This article is made available by BITE Investments (UK) Limited (“Bite UK”), a company incorporated in the United Kingdom (company registration number 11706620) with its registered office at 28 Ecclestone Square, London SW1V 1NZ. The information contained in this article (the “Information”) is for informational purposes only and may not be relied upon for the purposes of evaluating the merits of investing in any shares, other securities, limited partnership interests or other interests in any funds listed or referred to in the article or for any other purpose. The Information does not constitute an offer to acquire any limited partnership interests, shares or other securities, make any investment or to provide any fund management services or any investment advice of any kind, nor does this article constitute an invitation to invest, directly or indirectly, in any company or collective investment scheme, or to undertake to do so. Reliance on the Information for the purpose of engaging in any investment activity may expose the investor to a significant risk of losing all of the money invested. Nothing in this article is to be construed, and shall not be relied upon as, legal, regulatory, credit, business, tax or accountancy advice. The Information may change and there shall be no obligation on the part of Bite UK to update any of the Information. Data and facts used in this article are derived from sources which are considered to be reliable and have been compiled using Bite UK’s best knowledge. However, Bite UK does not guarantee the correctness of the Information. This article and the Information are strictly confidential and are used exclusively for a limited number of addresses. Reproduction of this article or the dissemination of this article, or the Information, to third parties, is not permitted.

Learn more about how Bite Stream can help you

Discover a solution that suits your needs