Fundraising for private capital managers has always been a laborious process. Institutional investors with long due diligence processes, regulations around KYC and AML, a labyrinth of paperwork, and a multitude of parties involved often creates bottlenecks and disjointed processes in getting to a fund close. In the current market environment, these challenges are only being exacerbated as smaller to mid-sized fund managers are finding it difficult to raise new capital given the lack of distributions back to LPs across the broader market.

Technology, for its part, has come a long way in helping investor relations, compliance, and back-office teams digitize many aspects of the fundraising process. One area where there have been positive advancements is in the investor onboarding process, where, thankfully, many GPs have moved to digitally onboarding their investors through electronic subscription docs and digital KYC/AML confirmation processes. This progress has benefited both GPs and LPs in reducing the time to onboard investors while reducing regulatory risk in the process. However, many of the point solutions dedicated to investor onboarding have not realized their full potential, sometimes creating more problems than they’re trying to solve.

The issue for fund managers arises when the onboarding solution lacks broader functionality that considers the entire fundraising process. This results in a disjointed, cobbled-together set of CRMs, data rooms/LP portals, e-subscription technology, and compliance solutions.

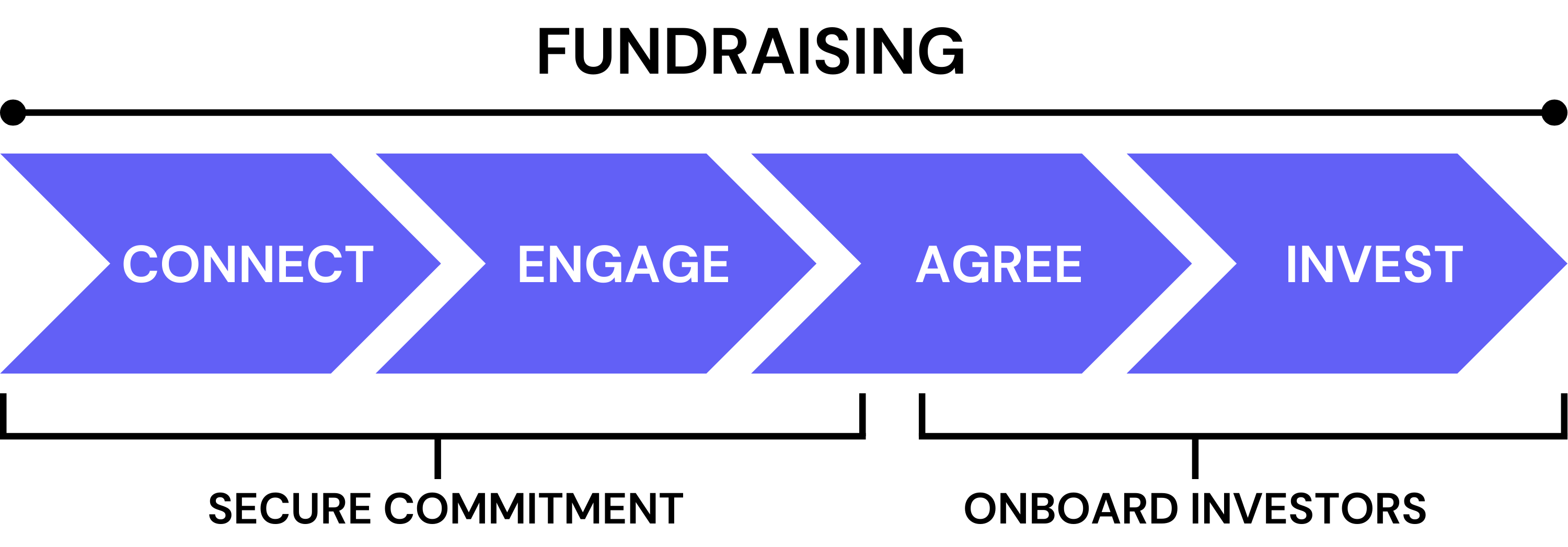

Raising a new fund can be divided into two distinct (yet very interconnected) work streams. The first involves engaging with both new and existing investors to secure a commitment, which typically consists of using a CRM and data room to support the marketing process. The second is the onboarding process, which involves completing the sub-docs and finishing the associated KYC/AML compliance reviews.

“You end up working for your technology instead of the technology working for you”

Numerous vendors offer solutions to the market that support distinct stages of the fundraising journey. In turn, many GPs have cobbled together these various pieces of technology to create efficiencies and build workflows to develop a holistic view of the targeted LPs. What ends up happening, though, is that it begins to take more work to get these applications to work together than the efficiency savings they should provide. You end up working for your technology instead of the technology working for you. Investor onboarding solutions are a prime example of a stand-alone technology that typically falls short when used in isolation from the rest of the fundraising technology.

Investor onboarding solutions are typically offered in two different configurations:

- Single-point solutions that are only focused on the onboarding part of the fundraising process – and do not offer solutions to help

- Integrated solutions that support the entire fundraising and investor management requirements – from the secure commitment workflow through the onboarding investor workflow

There are several significant drawbacks when using various point solutions in the fundraising process:

Lack of efficiency: Multiple-point solutions mean maintaining four or five different software applications. Learning, maintaining, and managing multiple systems requires resources and creates inefficiencies across IR, tech, and back-office teams.

Data silos: Point solutions can create data silos because they are designed to handle specific functions and may not integrate with other systems. This can lead to poor visibility of your potential investors as they navigate the fundraising process. At the same time, point solutions can lead to double or triple data entry, which can increase the likelihood of human error and wastes time transferring data between the different systems.

“The best technology in the world is of little value if it isn’t embraced by its intended users… The more applications a user has to learn and navigate, the less inclined the user will be to adopt said multiple platforms.”

Costs: Using multiple-point solutions inevitably costs more in the long run than a single integrated solution. That’s on top of maintaining agreements with multiple vendors with various contract lengths and conditions. There is also the hidden cost of the time wasted re-entering data from one system to another.

Adoption: The best technology in the world is of little value if it isn’t embraced by its intended users. The more applications a user has to learn and navigate, with multiple interfaces, documentation, and support channels, the less inclined the user will be to adopt said multiple platforms. There is a general aversion to adopting new technology by knowledge workers, given the aforementioned hurdles. Private asset managers are no exception.

Scale: As assets grow and more investors come in from multiple jurisdictions, technology needs to support the complexity that comes with expanding an LP base into other countries. Managing LP information from prospecting to onboarding can easily become unwieldy as fund managers look to raise bigger and bigger funds. Poorly integrated CRMs and onboarding solutions can limit the scale that growing GPs will need to keep their operations running properly. This challenge will only compound for managers looking to expand their investor base into the retail market. Fund managers looking to tap into this channel will face enormous needs for scale, given the smaller ticket sizes but same onboarding requirements as their institutional brethren.

Marketing and distribution: Given the challenges in today’s fundraising environment, managers are well advised to take advantage of every opportunity to reach LPs. With the advent of private investment marketplaces to attract and secure commitments, fund managers now have an additional channel with which to reach both institutional and non-institutional investors. When these marketplaces are integrated into other fundraising applications (i.e., CRM, data room), managers gain significant competitive advantages with brand awareness, distribution, and marketing efficiency. Most fundraising point solutions offer little – if at all – access to this kind of distribution functionality.

Risk: APIs are a common way to facilitate data transfers between systems. Unfortunately, stitching applications together poses risks, primarily in the way of security, with many APIs not properly designed with high-security standards in mind – not an ideal scenario when onboarding investors entails extremely sensitive information like passport IDs, tax information, and bank details. Additionally, APIs can be costly and only compound the number of applications that need to be maintained, further driving up costs.

Conclusion

Ultimately, fund managers should focus on the use cases involved in attracting, distributing, connecting, and onboarding investors and look at the technology (or, less recommended, “technologies”) that support those use cases as seamlessly as possible. Implementing an onboarding compliance solution in isolation from the other aspects of managing LP relationships can be a sub-optimal view of building the necessary tech stack.

Fundraising for private asset managers is a complicated process, typically involving many moving parts. There is also a fair amount of risk involved, both in maintaining goodwill with LP relationships and with regulations. The private capital world has been slowly moving away from stand-alone, siloed applications and into more fully integrated, module-focused applications. Fundraising and investor onboarding technology has finally followed suit. To learn more about what a holistic fundraising approach looks like, visit: https://www.biteinvestments.com/solutions/

Disclaimer: This article is made available by BITE Investments (UK) Limited (“Bite UK”), a company incorporated in the United Kingdom (company registration number 11706620) with its registered office at 28 Ecclestone Square, London SW1V 1NZ. The information contained in this article (the “Information”) is for informational purposes only and may not be relied upon for the purposes of evaluating the merits of investing in any shares, other securities, limited partnership interests or other interests in any funds listed or referred to in the article or for any other purpose. The Information does not constitute an offer to acquire any limited partnership interests, shares or other securities, make any investment or to provide any fund management services or any investment advice of any kind, nor does this article constitute an invitation to invest, directly or indirectly, in any company or collective investment scheme, or to undertake to do so. Reliance on the Information for the purpose of engaging in any investment activity may expose the investor to a significant risk of losing all of the money invested. Nothing in this article is to be construed, and shall not be relied upon as, legal, regulatory, credit, business, tax or accountancy advice. The Information may change and there shall be no obligation on the part of Bite UK to update any of the Information. Data and facts used in this article are derived from sources which are considered to be reliable and have been compiled using Bite UK’s best knowledge. However, Bite UK does not guarantee the correctness of the Information. This article and the Information are strictly confidential and are used exclusively for a limited number of addresses. Reproduction of this article or the dissemination of this article, or the Information, to third parties, is not permitted.

Learn more about how Bite Stream can help you

Discover a solution that suits your needs