In this article, we explore how and why investment managers (GPs) are rethinking the LP experience, and what this shift means for the wider network of fund administrators, wealth managers, and financial advisors.

The investor experience is undergoing a fundamental shift, going from a back-office concern to a top-tier priority shaping strategic decisions across the private capital ecosystem.

At the heart of this shift is a simple reality: investors now expect the same seamless, digital-first experiences they’re used to in everyday life. Fundraising challenges and regulatory pressures remain, but experience is becoming the true differentiator. To stay competitive — against mega-funds and public markets alike — GPs and their partners must put LP engagement at the center of their strategy. Technology is playing a critical role in helping firms deliver transparent, automated, and personalized investor journeys, even as operational demands grow more complex.

Beyond reporting: Redefining the investor experience in private markets

Over the last few years, investor expectations around communication and fund visibility have fundamentally shifted. In an increasingly competitive landscape, today’s discerning investor demands quality, transparency and speed when it communicates with GPs. LPs demand more than static reports – they expect on-demand digital experiences with access to real-time data, granular performance insights, and an empowering self-service functionality. Crucially, LPs need the right communications to allow swift decision-making and stay ahead of their competition.

What LPs expect today and why that’s a problem for GPs

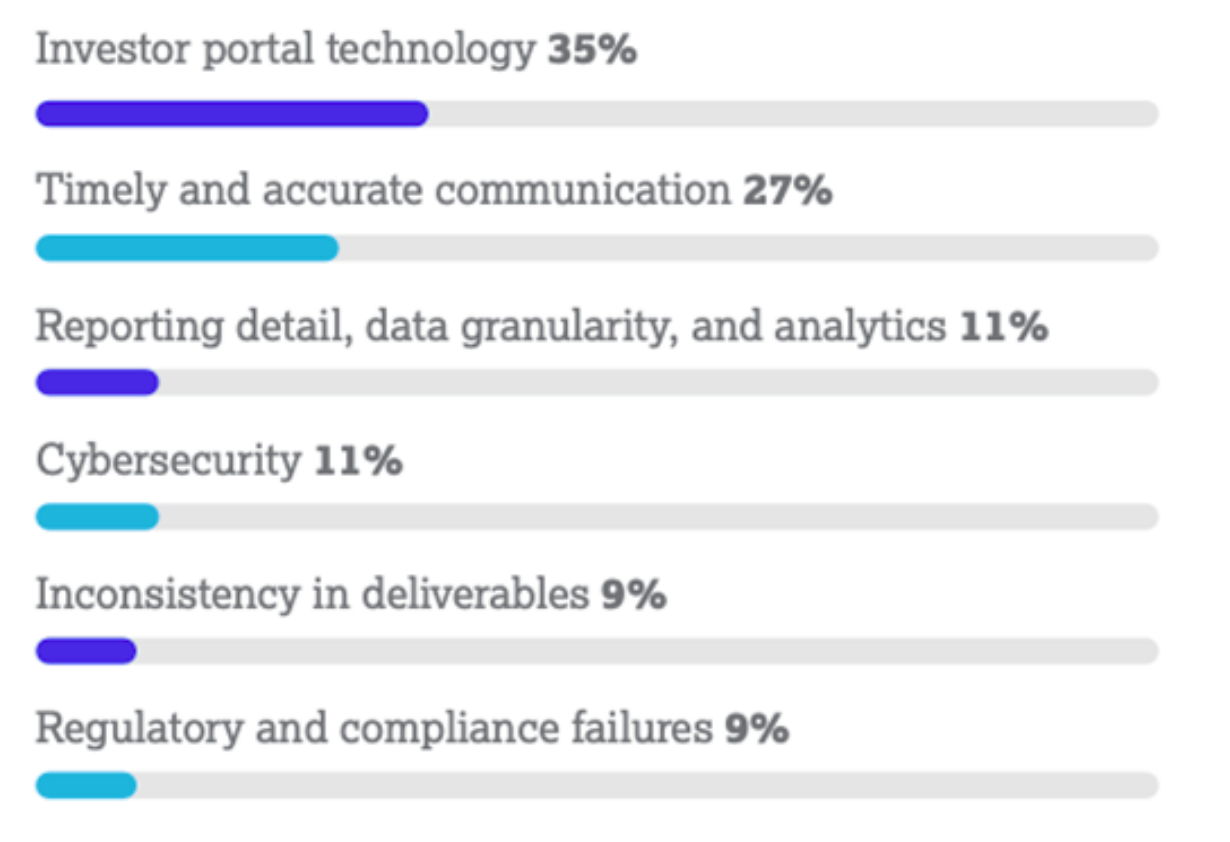

A recent article from The Drawdown exploring the expectations of private market investors made for fascinating reading with Figure 1 highlighting how investor portals are becoming increasingly problematic for LPs with 35% of respondents stating this is their biggest frustration[1].

Figure 1: LPs biggest frustration in working with fund GPs

Source: CSC, Future of Private Capital CFO Survey 2025[2].

Furthermore, 44% of the survey’s participants stated the level of detailed reporting, in terms of investment-level data and performance metrics, is not of the desired standard to reliably inform their decision-making process. To compound this issue, a staggering 74% of LPs now expect instantaneous access to key fund data, including reporting on portfolio performance and operational information such as NAV deadlines. Lastly, the research consistently found LPs overwhelming opt for self-service functionality with 89% stating more customer-facing self-service functionality is a must when using new technology.

While achieving the above is no easy feat for GPs, one thing is clear, having intuitive smart technology providing instantaneous real-time data is on the top of investor’s agendas.

The modern LP journey is digital and dynamic

The pathway for the modern investor to select, make and monitor investments is increasingly digital. From gaining tangible investment insights and uploading the required LP documentation to tracking performance data and reinvesting, today’s typical investor demands ‘always on’ access to vital information.

Thankfully, this can be achieved by offering intuitive, self-service portals that mirror the digital experiences LPs receive in other financial services or their daily lives; the world is now digital and the private marketplace should not be different. It’s unfathomable to think investors would wait weeks on end to receive basic fund information. Today’s LPs should have a seamless onboarding, reporting, and reinvestment experience. If GPs can’t match the digital experience LPs get elsewhere, they risk losing them to more forward-thinking, tech-enabled firms.

Common GP challenges in meeting investor demands

However, delivering the modern investor experience is far from straightforward. As stated on the NEXUS 2025 Private Equity International conference in Orlando, which the Bite Stream team attended, the insights into LP-GP pain points, gathered anonymously to encourage honest feedback, were fascinating.

While LPs cited common problems such as poor communications and a lack of tailored messaging, GPs attending the event, on the other hand, feel they are fighting against a tidal wave of fragmented and siloed legacy systems, making it difficult to manage LP data, track communications, and respond to queries efficiently.

At the conference, it was clear LPs need speedy and fully transparent reporting metrics which are individually tailored toward their specific needs. What’s also apparent is that LPs generally feel they do not receive this level of service on a consistent basis. However, the good news is that we spoke to numerous GPs who are aware of the issues and are actively taking steps to find the right, intuitive technology solution which they can trust to deliver on these increasingly high LP expectations.

Digital transformation enables end-to-end investor journeys

Our in-house research has found that investors typically have an average of 4.25 separate portals they’ll need to manage even when dealing with the same fund manager. This is a staggering statistic – no wonder fragmented systems are LPs’ biggest bugbear! With the technological capabilities at disposal in 2025, this is an issue GPs should be frantically working towards solving.

Thankfully, single source of truth platforms are now on hand to integrate workflows and seamlessly manage the full investor lifecycle from onboarding to eventually exiting the fund. This means that completing milestone tasks such as finalizing KYCs, signing all documents, accessing reports and capital calls, can be completed via one platform. Say goodbye to multiple logins and hard-to-navigate tech stacks!

What happens when you get it right: Strategic outcomes for GPs

- Enhanced investor engagement & brand differentiation

We’ve discussed the challenges GPs are faced with when trying to deliver on the growing LP demand for smart solutions. However, when they get it right, there are opportunities to truly thrive. Firms that offer seamless, branded, digital LP experiences can massively stand out in a competitive fundraising landscape, both today and in the years to come. With timely and transparent communication given to LPs on a consistent basis, long-lasting, trusted relations can be built.

- Reinvestment and scalable fundraising

Having the trust of your investor base has never been as important and fundamental to achieving reinvestment, helping GPs to swiftly complete future fundraising rounds. LP user experience is a critical factor in fundraising success and long-term investor attention, with smart technology playing a key role to help stand out in a challenging fundraising market.

GPs using the smartest tools store investor data to rapidly communicate and accelerate follow-on commitments, receiving that second investment in record time. With private equity funds taking the longest to close in over a decade, picking the right technology has never been so important for those LPs striving for swift follow-on commitments[3].

Why choose Bite Stream to redefine your LP experience

To conclude, what product can help GPs meaningfully redefine the investing experience of their LPs? With technology improving on an almost daily basis, there are now a plethora of new platforms to choose from but as we’ve highlighted previously, choosing the right technology is fraught with pitfalls for GPs to avoid – ranging from serious issues with compatibility to security concerns. Book a demo today with our Sales Team and you’ll start to see how Bite Stream could be the answer to keeping your LPs engaged and, most importantly, eager to invest in your next fund.

Sources:

[1] The Drawdown, The state of technology in private equity’s engine room, 30 April 2025

[2] CSC, Future Private Capital CFO Survey 2025, April 2025

[3] Pitchbook, PE funds are taking longer to close, but they’re getting massive, January 2025

Disclaimer: This article is made available by BITE Investments (UK) Limited (“Bite UK”), a company incorporated in the United Kingdom (company registration number 11706620) with its registered office at 28 Ecclestone Square, London SW1V 1NZ. The information contained in this article (the “Information”) is for informational purposes only and may not be relied upon for the purposes of evaluating the merits of investing in any shares, other securities, limited partnership interests or other interests in any funds listed or referred to in the article or for any other purpose. The Information does not constitute an offer to acquire any limited partnership interests, shares or other securities, make any investment or to provide any fund management services or any investment advice of any kind, nor does this article constitute an invitation to invest, directly or indirectly, in any company or collective investment scheme, or to undertake to do so. Reliance on the Information for the purpose of engaging in any investment activity may expose the investor to a significant risk of losing all of the money invested. Nothing in this article is to be construed, and shall not be relied upon as, legal, regulatory, credit, business, tax or accountancy advice. The Information may change and there shall be no obligation on the part of Bite UK to update any of the Information. Data and facts used in this article are derived from sources which are considered to be reliable and have been compiled using Bite UK’s best knowledge. However, Bite UK does not guarantee the correctness of the Information. This article and the Information are strictly confidential and are used exclusively for a limited number of addresses. Reproduction of this article or the dissemination of this article, or the Information, to third parties, is not permitted.

Learn more about how Bite Stream can help you

Discover a solution that suits your needs