From onboarding and accreditation to KYC, fund documentation, and cross-border eligibility, compliance now touches nearly every investor interaction. It’s embedded in the earliest stages of engagement, influences how quickly LPs can subscribe, and underpins the transparency they expect post-investment.

As global regulators tighten AML standards, redefine investor categories, and mandate new ESG and operational disclosures, managers would do well to keep their eye on how new rules can potentially impact their operations. The 2025–2026 regulatory cycle brings sweeping changes across the U.S., U.K., EU, and Asia, turning fragmented obligations into a global operating challenge.

This roadmap outlines what’s happened in 2025, what’s ahead, and how future-ready firms can use technology to embed compliance across the investor lifecycle – accelerating onboarding, reducing risk, and building the trust needed to scale capital faster.

United States

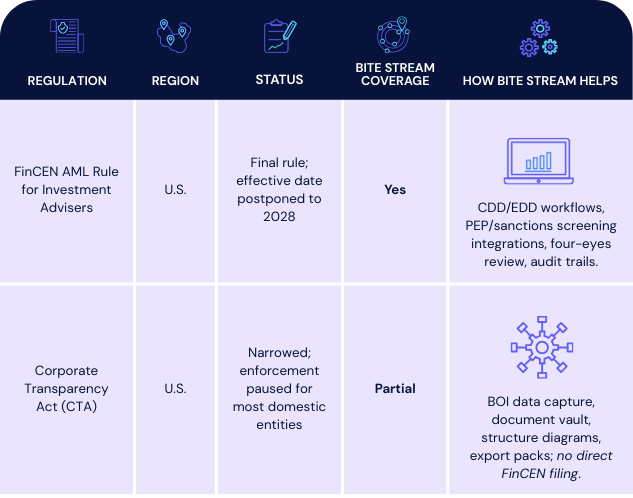

FinCEN AML Rule for Investment Advisers

- What it is: A long-anticipated rule that would place private fund advisers (including Exempt Reporting Advisers across PE/VC/Hedge) under the Bank Secrecy Act (BSA). It would require a written AML/CFT program, appointment of an AML officer, Suspicious Activity Report (SAR) filing, ongoing risk-based Customer Due Diligence (CDD), training, testing, and recordkeeping.

- Status: Delayed. Final rule adopted in 2024, with the effective date postponed to 1 January 2028. Policymakers have signaled intent to revisit; market consensus expects renewed action with phased obligations now beginning in 2028.

- Bite Stream support: Configurable AML/CDD workflows with smart forms, PEP/sanctions screening integrations, four-eyes acceptance and audit trails, plus jurisdictional gatekeeping to pre-screen investors by geography and type. These let managers stand up a BSA-aligned control environment in advance of the final rule.

Accredited Investor Definition Review Act (H.R. 3348)

- What it is: A bill that would amend the Securities Act of 1933 and the Dodd-Frank Act to allow the SEC to formally recognize specific professional certifications, designations, and credentials as alternative pathways for individuals to qualify as accredited investors. The legislation would include certifications already referenced in the SEC’s 2020 order, require an initial review within 18 months of enactment, and mandate recurring reviews at least every five years to keep the list current.

- Status: Reported (Amended) by the House Financial Services Committee on June 4, 2025, and placed on the Union Calendar (No. 103); awaiting House floor consideration (introduced May 13, 2025).

- Bite Stream support: Bite Stream can gate access to offerings by accredited status, capture and store credential evidence, and provide segmented marketplace views and audit logs, while leaving legal determinations/filings to counsel and authorized approvers.

“Bite Stream can gate access to offerings by accredited status, capture and store credential evidence, and provide segmented marketplace views and audit logs, while leaving legal determinations/filings to counsel and authorized approvers.”

Corporate Transparency Act (CTA)

- What it is: Requires most U.S. legal entities (including many GP/LP vehicles, SPVs, and feeders) to report Beneficial Ownership Information (BOI) to FinCEN. Centralizes entity transparency to combat shell-company misuse and complements KYC.

- Status: Narrowed and partly paused. BOI filing obligations began in 2024 with continuing guidance, but 2025 litigation and Treasury/FinCEN actions have suspended enforcement for most domestic reporting companies and refocused the regime on foreign reporting companies.

- Bite Stream support: BOI data collection during onboarding (owners/controllers, percentages, ID docs) and exportable packages for counsel/filers. Note: Bite Stream does not file BOI directly with FinCEN; managers file via counsel or corporate services.

United Kingdom

Register of Overseas Entities (OER) – Trust/Beneficiary Expansion

- What it is: Expands disclosure obligations for foreign entities (including trusts/nominees) that hold UK property or other registrable interests, requiring identification of beneficial owners and beneficiaries and ongoing updates.

- Status: Enforcement in effect as of 31 Aug 2025 for the disclosure deadline; enforcement and penalties expected post-cut off. Companies House guidance is active.

- Bite Stream support: Trust-aware questionnaires (settlor/trustee/protector/beneficiary roles), secure document collection, and review workflows to resolve gaps or inconsistencies before submission.

FCA Financial Promotions Regime Reform

- What it is: Tightens rules around who may approve/receive promotions of high-risk investments, strengthens HNW/sophisticated categorization, and heightens expectations for digital channels and intermediated distribution.

- Status: Largely in force, with supervision and remaining refinements phased across 2025–2026 with emphasis on digital marketing and approvals.

- Bite Stream support: Access controls by investor type/jurisdiction, eligibility gatekeeping and attestations, campaign audit logs, and engagement analytics in the Comms Centre/CRM. Note: FCA approval/approver responsibilities sit outside the platform; managers must use an authorized approver.

UK SDR (Sustainability Disclosure Requirements)

- What it is: UK regime introducing product labels, anti-greenwashing rules, and standardized disclosure templates for ESG strategies (Article-style categorization analogous to EU SFDR).

- Status: Final rules in place since late 2023; phased implementation running 2024–2026.

- Bite Stream support: ESG data fields and attestations in onboarding, tagging of fund materials, and segmented portal views for ESG products. Note: Full SDR template generation/filing is handled outside the platform.

European Union

EU AML Regulation (AMLR)

- What it is: A single, directly applicable rulebook replacing patchwork directives. Sets uniform CDD thresholds (identity checks ≥ €3,000, full CDD ≥ €10,000), UBO verification (≥25% ownership/control), PEP/sanctions screening, and stronger governance/recordkeeping for obliged entities, including AIFMs and distributors.

- Status: Adopted (2024); in the implementation period with direct application from 2027. Technical standards and supervisory guidance forthcoming.

- Bite Stream support: Threshold-aware CDD logic, integrated screening, risk scoring, role-based permissions, immutable audit trails, and multi-jurisdiction onboarding that enforces EU-specific data capture and evidence retention.

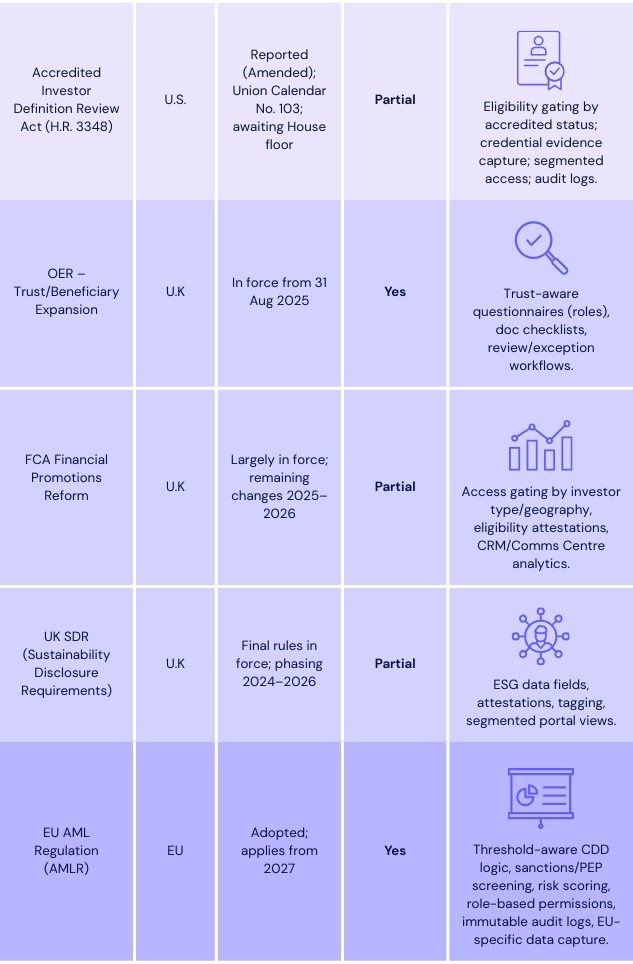

AMLA – Anti-Money Laundering Authority

- What it is: New EU-level supervisor (Frankfurt) with powers to directly oversee high-risk/cross-border financial institutions, run joint examinations, and impose penalties – bringing consistency to enforcement across Member States.

- Status: Set‑up phase largely complete; operational go‑live in mid‑2025 with direct supervision ramping up later in the decade.

- Bite Stream support: Compliance dashboards showing investor risk, documentation status, pending reviews, and exportable evidence (who did what/when) to support AMLA or NCA examinations.

AIFMD II

- What it is: Updates to the EU’s alternative fund regime: tighter pre-marketing notifications, refreshed delegation/outsourcing oversight (including non-EU service providers), and enhanced disclosures around costs/risks/liquidity for investors.

- Status: Adopted; application expected 2026 alongside Level-2 measures.

- Bite Stream support: Disclosure-ready onboarding (acknowledgments, suitability gates), document approvals, CRM-linked distribution pipelines, and data room/portal controls for differentiated LP access. Regulatory reporting to NCAs remains outside the platform.

DORA (Digital Operational Resilience Act)

- What it is: EU framework for Information and Communication Technology (ICT) risk management, incident reporting, digital operational resilience testing, and third-party risk oversight for financial entities using cloud/outsourced tech.

- Status: In force since Jan 2025; first supervisory assessments underway with further milestones through 2025–2026.

- Bite Stream support: Hosted on Microsoft Azure, with 2FA/MFA, encryption, API logging, and evidence packs (penetration tests, uptime/SLA reporting) readily shareable for vendor due-diligence.

Asia: Singapore & Hong Kong

MAS AML Evolution (Singapore)

- What it is: MAS promotes RegTech-enabled AML with perpetual KYC, dynamic risk reviews, source-of-wealth/source-of-funds analysis, and stronger oversight of distributors serving HNW channels.

- Status: Ongoing supervisory initiative with thematic inspections and guidance refreshes continuing through 2025–2026.

- Bite Stream support: Profile re-use across raises, assisted-invest workflows for RIAs/IFAs, and configurable review queues to escalate EDD and collect SoW/SoF evidence.

SFC Enforcement Expansion (Hong Kong)

- What it is: Heightened enforcement on layered/offshore LP structures, SoW/SoF verification, and ongoing monitoring; focus on private funds with complex cross-border investor bases.

- Status: Enforcement ramp-up with thematic reviews targeting onboarding and documentation quality.

- Bite Stream support: Document checklists per entity tier, status tracking across reviewers (fund counsel/admin), and audit logs to evidence periodic reviews.

The Bottom Line: Don't Get Caught Off Guard

The next wave of global regulation isn’t just about checking the boxes, it’s about unlocking scale, workflow clarity and investor trust.

For private capital managers, embedding compliance into onboarding, subscription, and reporting processes enables faster closings, smoother cross-border fundraising, and more trusted LP relationships.

With Bite Stream, regulatory workflows are built into the investor experience, seamlessly integrated into onboarding, AML/KYC checks, accreditation, document execution, and post-investment reporting. This turns fragmented, manual compliance tasks into a unified, automated process that scales effortlessly across jurisdictions and investor types, saving time, reducing risk, and improving the LP experience at every stage.

The regulatory tide is rising. The question isn’t whether these changes will impact your business – it’s whether you’ll ride the wave or get swept away by it.

Ready to get ahead of the curve? Don’t wait for enforcement to begin – start building your regulatory resilience today.

“The next wave of global regulation isn’t just about checking the boxes, it’s about unlocking scale, workflow clarity and investor trust.”

Summary Table: Regulation, Status & Bite Stream Coverage

Disclaimer: This article is made available by BITE Investments (UK) Limited (“Bite UK”), a company incorporated in the United Kingdom (company registration number 11706620) with its registered office at 28 Ecclestone Square, London SW1V 1NZ. The information contained in this article (the “Information”) is for informational purposes only and may not be relied upon for the purposes of evaluating the merits of investing in any shares, other securities, limited partnership interests or other interests in any funds listed or referred to in the article or for any other purpose. The Information does not constitute an offer to acquire any limited partnership interests, shares or other securities, make any investment or to provide any fund management services or any investment advice of any kind, nor does this article constitute an invitation to invest, directly or indirectly, in any company or collective investment scheme, or to undertake to do so. Reliance on the Information for the purpose of engaging in any investment activity may expose the investor to a significant risk of losing all of the money invested. Nothing in this article is to be construed, and shall not be relied upon as, legal, regulatory, credit, business, tax or accountancy advice. The Information may change and there shall be no obligation on the part of Bite UK to update any of the Information. Data and facts used in this article are derived from sources which are considered to be reliable and have been compiled using Bite UK’s best knowledge. However, Bite UK does not guarantee the correctness of the Information. This article and the Information are strictly confidential and are used exclusively for a limited number of addresses. Reproduction of this article or the dissemination of this article, or the Information, to third parties, is not permitted.

Learn more about how Bite Stream can help you

Discover a solution that suits your needs