Anna Barath, Bite’s Head of Fund Investments, writes on the role of private equity in an inflationary environment for Private Banker International.

Record levels of inflation across the globe are causing investors to evaluate their portfolios to hedge against the current inflationary environment; private equity being particularly examined. Notably, according to a recent story in Bloomberg News, the consensus among traders is that the Bank of England will have no choice but to force the economy into a severe recession and cause widespread job losses to rein in price pressures. Anna Barath, head of fund investments at Bite Investments, writes

Against this backdrop, the flexibility of private equity is demonstrated by its ability to respond to the current economic environment, selecting investments better suited in nature to thrive during periods of high inflation. Private equity strategies, such as real estate and infrastructure, as well as adjacent private markets strategies, such as private credit, display a number of attractive characteristics when looking to hedge against high levels of inflation, furthering the argument to include these asset classes as part of balanced investment portfolios.

Private equity’s historic performance and lower correlation to traditional investments offer investors a valuable tool in portfolio optimisation, allowing investors to benefit from the principle of diversification. By allocating a portion of their portfolio to private asset classes, investors can hope to simultaneously improve returns while reducing volatility.

As such, creating value through private equity is essential for fund managers and adding the latest technology solutions improves and expands access to private equity strategies to new investors. To tap into the possible opportunities that these new pools of capital represent, alternative asset managers are providing a fully digital experience to their investor base, including digital onboarding and subscription processes. End-to-end digitisation for general partners reduces administrative costs, streamlines investor processes, and provides them with the tools to access an ever-expanding wealth management market.

Private equity firms’ active approach differs from public equity managers. It is about creating value alongside the management of their investee companies rather than just picking winning companies. Fund managers select assets where they see potential to fundamentally improve and even transform businesses, helping private equity consistently outperform public markets throughout different economic cycles.

Record levels of global inflation

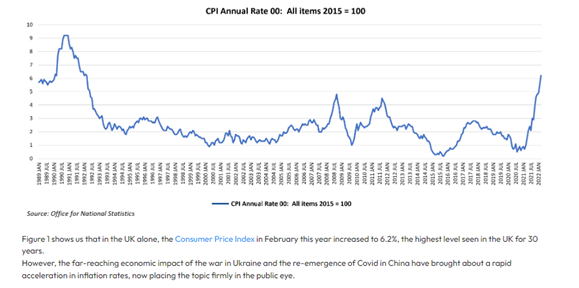

Due to the economic turmoil resulting from Covid-19, inflation globally has been steadily increasing for the last two years.

Figure 1: UK Consumer Price Index in February 2022 reached a record high for 30 years

In normal times, it is common practice for businesses to increase revenue while keeping costs under control. However, when inflation climbs, costs start to increase at a faster rate, meaning businesses struggling to grow revenue faster than their outgoing costs, or unable to pass on increases to their customers, will be adversely impacted. Those with lower relative fixed costs and a strong market standing will be able to weather the economic climate. However, companies unable to outmanoeuvre the rising costs will be set for an incredibly challenging period.

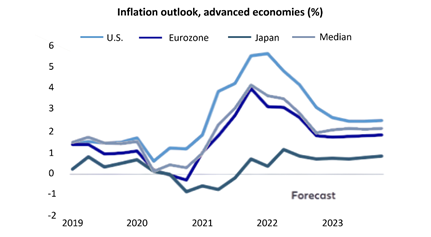

Figure 2: Rising inflation rates are very much a global occurrence with many regions

Figure 2 confirms rising inflation rates as a global occurrence, with many regions recording some of the highest levels seen in recent times, leaving investors searching for tangible solutions to help minimise their exposure to the current inflationary environment.

Private equity: Selecting businesses with winning characteristics

With that in mind, private equity investments become even more crucial as there are businesses that will naturally struggle in these times of high inflation.

Fund managers can select investments suitable for the current economic climate – choosing to invest in businesses from any industry with a strong market position that offers mission-critical products enabling them to pass on future price rises to their consumers without sacrificing order volumes.

Additionally, when investing in private equity, there is the advantage of a fund manager in control of the company, experienced in creating value throughout different and, at times, challenging economic cycles. They will work with management teams to enhance value wherever possible, which could involve addressing potential supply chain issues, undertaking cost-saving exercises, or adopting a more proactive ‘buy and build’ strategy by acquiring competitors and increasing their market share.

All in all, private equity has historically consistently demonstrated its ability to outperform its public equivalents in uncertain economic times, and inflationary periods are no different.

Source: Private Banker International