In his latest op-ed for WealthManagement.com‘s 2025 Market Outlook (page 144), William Rudebeck, Bite Investments’ CEO & Co-Founder, discusses the retailization of private markets and its impact on the investment industry. He explores how retail access to private assets unlocks new opportunities for investors, wealth managers, and private asset managers, while addressing the operational challenges and the role of technology in this evolving landscape.

The retailization of private assets is revolutionizing the investment industry landscape, bridging the gap between an investment opportunity universe once reserved solely for institutions and the high net worth community. With the proliferation of new, semi-liquid, evergreen funds coming to market, along with the advent of alternative investment platforms for retail investors and their advisors, there will be secular advantages for advisors, investors, and managers in the years ahead.

Wealth Managers and HNW Investors

Benefits:

- The illiquidity premium – the alpha expected over liquid securities – has proven persistent over the long term, providing a meaningful return over public equity indexes.

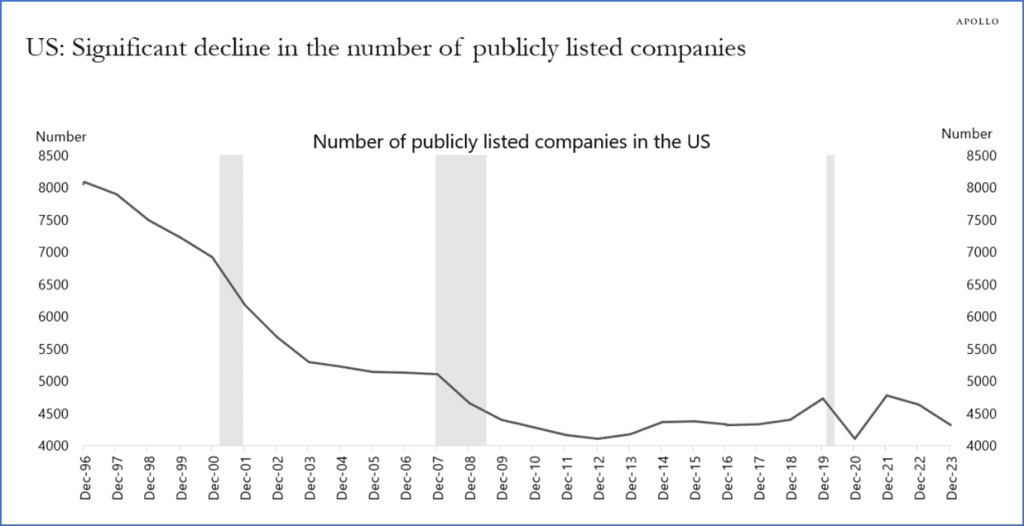

- A dwindling list of publicly available stocks to invest in means fewer alpha opportunities for actively managed long-only equity managers. In fact, the number of publicly listed companies has declined 50% since the mid-1990s.

- Private credit and private real estate can support the income portion of an individual’s cash flow needs above and beyond government and corporate bonds, reducing exposure to shorter-term interest rate fluctuations.

- To attract retail investors, managers must develop new products and investment vehicles that cater to this market segment. This innovation can lead to more efficient and transparent investment options and lower costs, benefiting investors.

- Incorporating alternatives as part of a wealth manager’s investment universe provides competitive advantages for RIAs and wealth managers who embrace the private markets over those that remain laggards in adopting new investment options for their clients.

Caveats:

- The private asset markets are less liquid and transparent than their public security counterparts. However, this is being addressed due to the proliferation of evergreen, BDCs, and interval funds coming to market, providing “semi-liquid” options with more frequent reporting intervals.

- The fees to invest in the private markets are notably higher than those in the public markets.

Private Asset Managers

Benefits:

- New revenue streams of perpetual vehicles reduce the cyclical nature of traditional drawdown funds while providing a steady stream of recurring management fees.

- The diversification of a manager’s client base into the retail market increases the investor pool and reduces institutional client concentration.

- Given the (still) untapped penetration of the retail market, smaller and mid-sized managers have an opportunity to establish themselves in this vertical. They will still have to compete, though, with the deep resources of larger private managers. Education, brand establishment, and competitive returns will determine who wins the retail AUM game in the years ahead.

Caveats:

- The operational capabilities – people, compliance, reporting – to compete effectively in the retail markets cannot be overstated. The ability to scale will be paramount given the costs and resources needed. Technology will play an important role in onboarding, compliance, investor communication and product distribution.

- There is the potential for a mismatch of liquidity, strategy, and investor expectations, particularly for semi-liquid funds. Careful consideration will be needed to right-fit strategy and vehicle.

- Fees paid to intermediary platforms/distribution often come at a cost, potentially significantly affecting margins.

Conclusion:

Demographic shifts, a large, untapped universe of potential capital and friendlier regulatory environments point to an important shift in the private capital markets. New, diversified investment options for advisors and their investors, along with the greenfield opportunities for private market managers bodes well for the health of the industry going forward.

Source: WealthManagement.com (page 144)