2024 began with renewed momentum in fundraising. Despite 2023 being one of the most challenging years in private markets in over a decade, the start of this year subsequently saw fundraising pick up.

Still, as the year ends, the fundraising picture remains complex. Geopolitical uncertainties and an unpredictable macroeconomic climate have made fund managers and their investors more cautious.

What remains clear is the enduring attraction of private markets. There are, and always will be, an array of opportunities for savvy managers to navigate any challenging headwinds and meet growing investor demands across the globe.

The Good: Private Equity (PE) raising capital beyond records

We predicted an uptick in fundraising activity across the private markets, and true to our word, 2024 was off to a promising start! A total of $408.6 billion was successfully raised across 861 final closes in the first half of 2024[1]. This compares to $374.6 billion raised over the same period in 2023. Although still below the peaks of 2021 and 2022, PE continues to perform well compared to pre-pandemic levels.

In Europe, PE fundraising achieved an impressive €118bn in H1 2024[2]. If this trend holds, Europe could be on course for a record-breaking fundraising year.

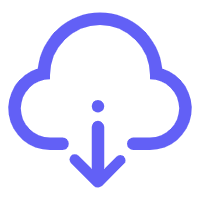

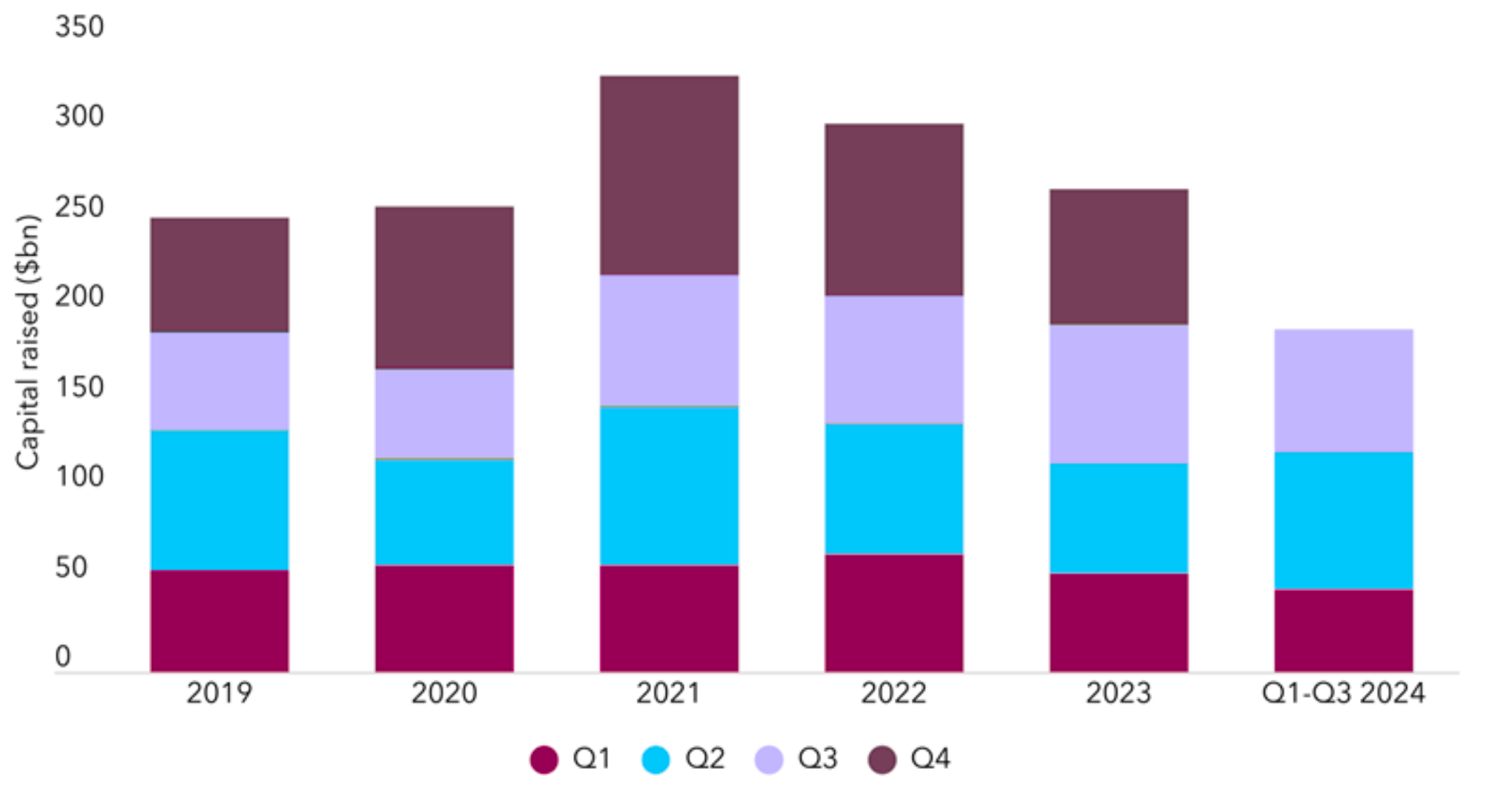

In the US, PE fundraising as of September 30 totaled approximately $236 billion, reinforcing PE’s strong performance. As shown in Figure 1 below, the asset class is set to surpass pre-pandemic fundraising levels.

Figure 1: PE Fundraising activity

Source: PitchBook | Geography US | As of September 30, 2024

Recent global data further supports this trend, indicating that PE fundraising is on track to match or exceed 2023 totals. While there are signs of a slowdown in the second half of the year, PE remains a beacon of stability within private markets.

The Bad: Challenges continue for some asset classes

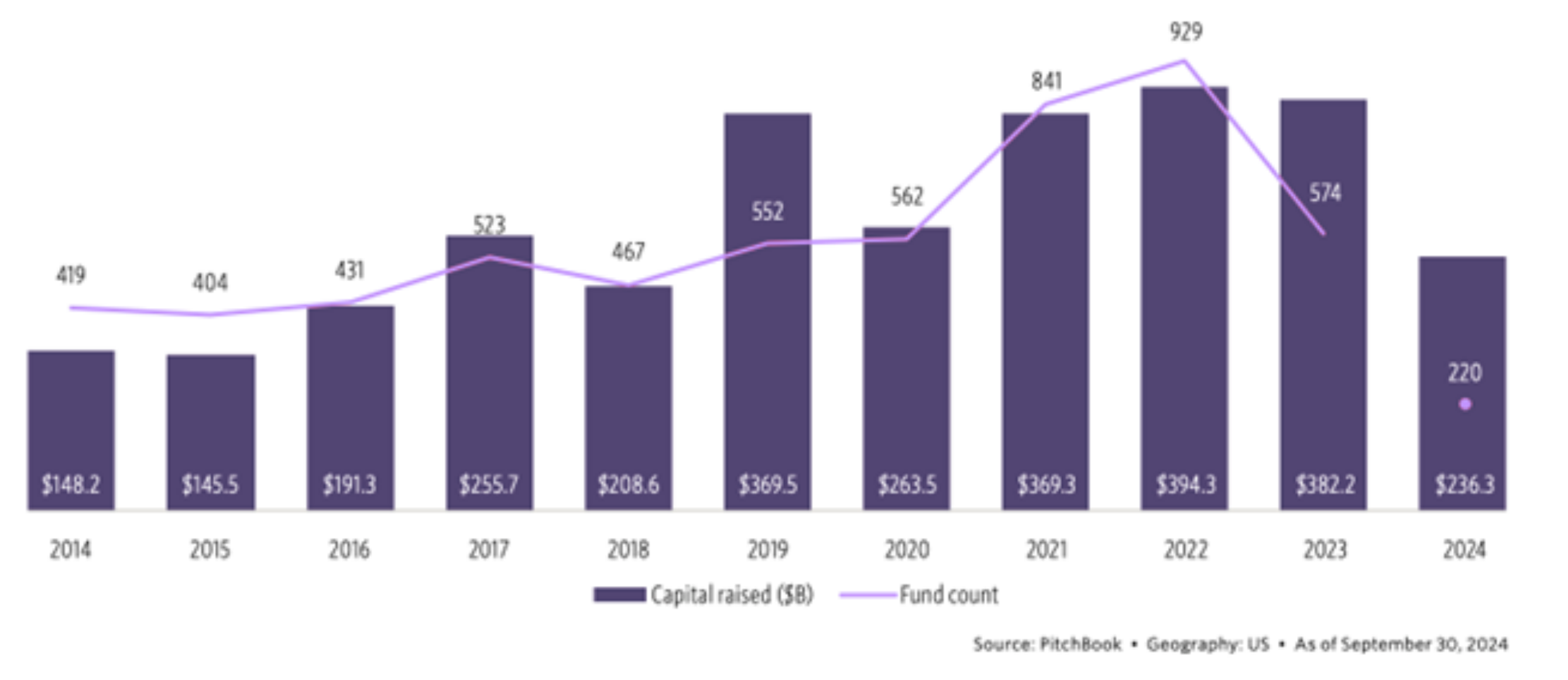

For certain private market asset classes, 2024 has remained an incredibly challenging year for raising capital. While private equity has performed better than some, it was not immune to difficulties over the year, with the asset class taking considerably longer to reach fundraising targets. This is largely due to a challenging exit market (e.g. a decline in M&A activity and the continued stagnation of IPOs), which has led to a decrease in distributions to investors, thereby limiting the amount of capital available for new funds.

“While capital remains available, many fund managers are having to work harder and longer to secure commitments and complete fundraising.”

Figure 2[3] shows that the average time between fund launch and final close has doubled since 2019. This indicates that while the capital remains available, many fund managers are having to work harder and longer to secure commitments and complete fundraising.

Figure 2: Average length of time between fund launch and final close has doubled since 2019

Source: Private Equity International

In addition, early data[4] for the third quarter of 2024 confirms another slowdown, with PE fundraising seeing a 21.6% drop to $134.6 billion, compared to $171.6 billion raised in Q2. Still, there is a ray of light, as some industry commentators[5] suggest that a stabilizing interest rate environment may help reverse this trend heading into 2025, with a more positive fundraising outlook expected.

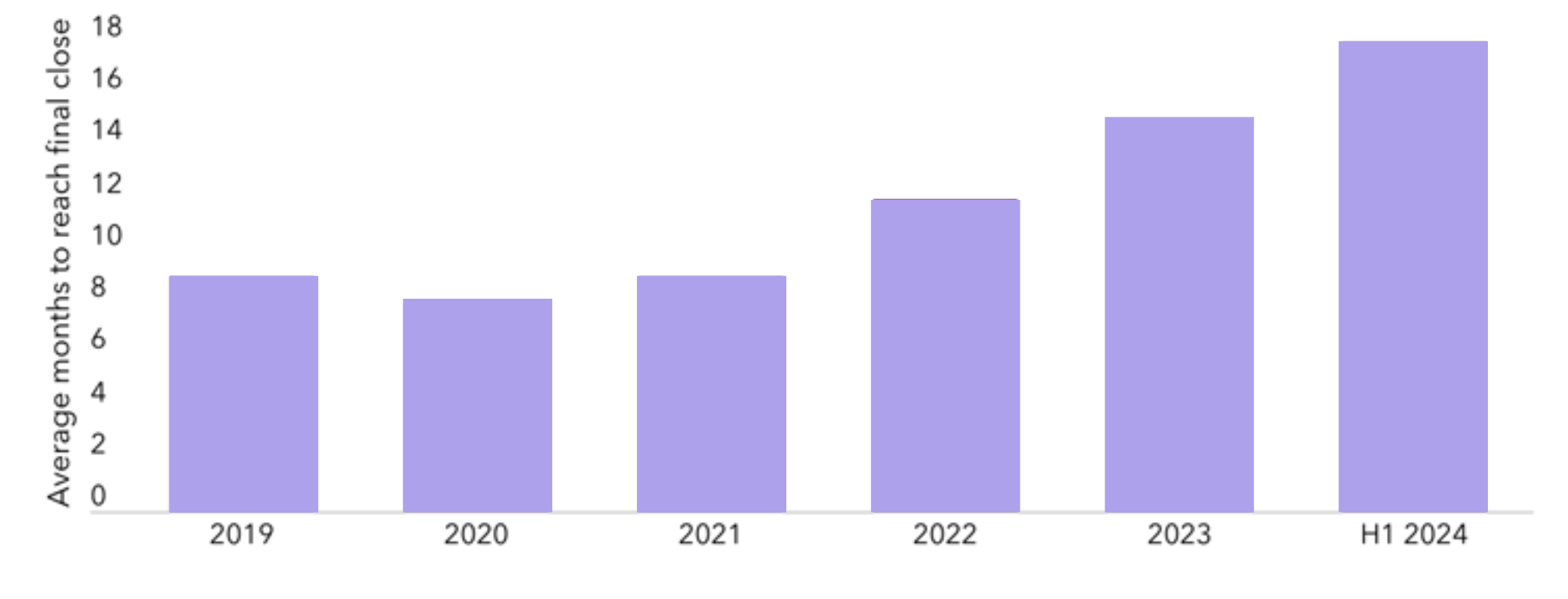

Global venture capital (VC) fundraising has also not seen the turnaround in fortunes many predicted at the start of 2024. The total capital raised for the first three quarters of the year was at its lowest levels in five years. If fundraising in the final quarter of the year is similar to that of the third quarter of the year, 2024 could mark the weakest year for VC fundraising since 2020.[6]

Unfortunately, the outlook for first-time VC funds is even gloomier. As we can see from Figure 3[7], debut US funds are struggling to raise capital and are significantly down from 2023. This indicates a strong preference among investors for well-established fund managers as opposed to new entrants on the market.

Figure 3: VC first time fundraising activity

Source: Pitchbook – NVCA Venture monitor | As of September 30, 2024

The increasingly popular private credit asset class has also had a mixed year. As shown on Figure 4[8] below, private credit fundraising recorded its lowest Q1 total in over six years but has since begun to (almost) catch up to 2023 levels. However, it will need a strong final quarter to match last year’s total.

Figure 4: Year-on-year private credit fundraising

Source: Private Debt Investor

The Complex: An important yet hard to predict Q4

The final quarter of the year will be a critical period for private markets fundraising. Can fundraising levels stay on track or perhaps even surpass the total capital raised in 2023? Or will the final quarter of the year prove to be as challenging as the first? Unfortunately, answering these questions is no easy feat.

We have certainly seen a complex global macroeconomic environment in 2024. Rising interest rates in response to central banks worldwide fighting inflation and stagnant growth levels have slowed fundraising this year. Additionally, ongoing global conflicts and various political shocks with international consequences are encouraging investors and fund managers to proceed with caution in the short term.

However, is some of this uncertainty beginning to ease? While global conflicts persist, major elections have been and gone, offering financial markets a glimpse of consistency, for now. Find out more on this from Bite Investments’ Chief Investment Officer, Anna Barath, and Managing Director, Justin Mason, in their latest webinar from our private markets update series.

2025 Outlook: Savvy investors will lead the way

This final quarter of the year is pivotal and could set the tone for fundraising in 2025. If a strong quarter is recorded, it should increase market confidence going into the new year. Conversely, if we see a Q4 slowdown, investors may adopt a more cautious, “wait and see” approach. But despite the unknowns, we expect a strong end to the year for fundraising across the private markets. As highlighted above, we have seen momentum build since the start of the year, and we anticipate this to continue.

Looking ahead to 2025, we expect fundraising levels to rise further. While many asset classes have faced challenges in fundraising this year, and we are by no means out of the woods yet, a general decrease in interest rates throughout Europe and the US is widely expected next year. This should lead to enhanced exit opportunities, which, in turn, should boost investor confidence.

“Managers should focus on upgrading legacy systems with digital-first, integrated, secure solutions to position themselves for long-term success.”

Despite the predicted upturn, challenges will remain, and fundraising will be highly competitive. Only the most savvy and innovative fund managers will succeed. While tech tools offer immense potential for streamlining operations and gaining a competitive edge, the sheer number of options can make it difficult to know where to start. Managers should focus on upgrading legacy systems with digital-first, integrated, secure solutions to position themselves for long-term success. Specifically, we expect more managers to explore new software to tap into the wealth management channel and target the much-coveted new breed of retail investors interested in private markets, who demand enhanced experiences, such as investor portals or digital marketplaces suited to today’s digital era.

It’s clear that 2024 has presented its share of challenges, but through all the uncertainty, private markets have continued to demonstrate enduring resilience. Looking ahead to 2025, we expect increased fundraising, but as always, only the most innovative and streamlined managers will thrive.

Sources:

[1] Private Equity International, Private equity fundraising sees modest rebound in H1 2024 as timelines soar – updated, July 2024

[2] Preqin, European private equity sees record pace in fundraising in H1 2024, but is set to slow — Preqin reports, October 2024

[3] Private Equity International, Private equity fundraising sees modest rebound in H1 2024 as timelines soar – updated, July 2024

[4] Preqin, Private markets remain muted in Q3, but recent interest rate cuts could prove a tailwind, October 2024

[5] M&G Investments, Investment Perspectives 2025 Outlook: No time for complacency, December 2024

[6] Venture Capital Journal, Global fundraising report for Q3 2024, October 2024

[7] Pitchbook – NVCA, Venture Monitor Q3 2024, October 2024

[8] Private Debt Investor, Fundraising report Q3 2024, October 2024

Disclaimer: This article is made available by BITE Investments (UK) Limited (“Bite UK”), a company incorporated in the United Kingdom (company registration number 11706620) with its registered office at 28 Ecclestone Square, London SW1V 1NZ. The information contained in this article (the “Information”) is for informational purposes only and may not be relied upon for the purposes of evaluating the merits of investing in any shares, other securities, limited partnership interests or other interests in any funds listed or referred to in the article or for any other purpose. The Information does not constitute an offer to acquire any limited partnership interests, shares or other securities, make any investment or to provide any fund management services or any investment advice of any kind, nor does this article constitute an invitation to invest, directly or indirectly, in any company or collective investment scheme, or to undertake to do so. Reliance on the Information for the purpose of engaging in any investment activity may expose the investor to a significant risk of losing all of the money invested. Nothing in this article is to be construed, and shall not be relied upon as, legal, regulatory, credit, business, tax or accountancy advice. The Information may change and there shall be no obligation on the part of Bite UK to update any of the Information. Data and facts used in this article are derived from sources which are considered to be reliable and have been compiled using Bite UK’s best knowledge. However, Bite UK does not guarantee the correctness of the Information. This article and the Information are strictly confidential and are used exclusively for a limited number of addresses. Reproduction of this article or the dissemination of this article, or the Information, to third parties, is not permitted.

Learn more about how Bite Stream can help you

Discover a solution that suits your needs