A ‘Bite’ of Private Markets – delivering Facts, Insights & Strategies

ESG investing landscape

William Rudebeck

Chief Executive Officer

Overview

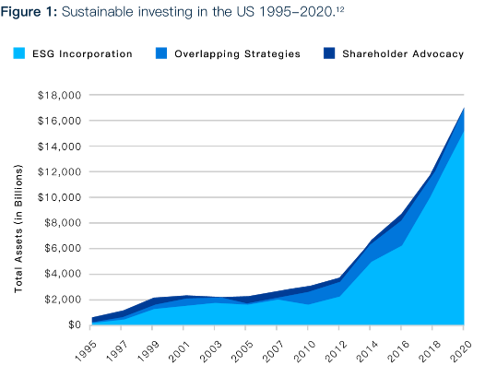

Environmental, social and governance (ESG) investing has gone mainstream. Investors are increasingly looking at an organisation’s sustainable practices, social involvement and governing principles and operations when assessing potential investments. Research has found that companies with strong ESG performance metrics are attracting eco- and socially conscious investors, especially those within the younger generations. These investors also value ESG investments for their risk mitigation role. While European investors have led in ESG investing, the trend is growing across other regions as well.

The pandemic may have dominated the past two years, however it did nothing to slow down the increasing investor appetite for ESG investments. To the contrary, it brought more attention to cause-based investing as supply chain challenges, coupled with high profile climate change crises, heightened investors’ awareness of the need to further consider the ramifications of their investment choices.

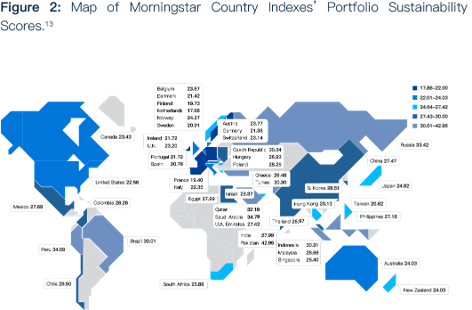

ESG investing has tended to follow certain regional trends. For instance, European investors’ ESG investing has focused more on environmental issues, whereas American investors favour social impact causes. In Hong Kong SAR, China, corporate governance dominates as an ESG investing focus.[1] Notably, across broader Asia, the past few years have recorded an impressive rise in target allocations to ESG investments.

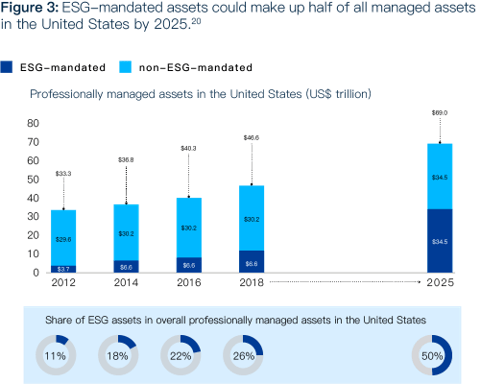

Overall, and according to the EY 2020 Global Alternative Fund Survey, almost half of all investors expect the amount of ESG investing in infrastructure, private equity, and real estate to increase over the next two to three years.[2] With that said, the proportion of socially conscious investors seeking ESG investments appears to be outpacing the number of alternative managers offering these investments. The same survey found that currently just 20% of managers offer ESG products, which is the same percentage as in 2019, and just 7% indicated plans to offer ESG products, while 73% stated they do not offer or plan to offer ESG products.[3]

Currently, the amount of professionally managed portfolios that have incorporated key components of ESG investing exceed USD 17.5 trillion globally, and ESG-related traded investment products now available to both institutional and retail investors exceed USD 1 trillion.[4] Almost one third of public market capital is committed to ESG and impact investments[5] with increasing ESG investing occurring in the private markets. With the growing demand for ESG, and the apparent need for more offerings by alternative managers, there is a window of opportunity for those market-responsive managers to capture new investors by expanding their suite of ESG products. The ESG-oriented investment environment is an attractive one as data such as that provided by McKinsey demonstrates a direct link between a focus on sustainability markets and products to higher value creation.[6] Further, and in addition to top-line growth, improved ESG performance can also correlate with cost reductions, decreased regulatory and legal interventions, and reduced downside risk achieved.

Behind The Numbers

· $16.6 trillion in US-domiciled assets at the beginning of 2020 were held by 530 institutional investors, 384 money managers and 1,204 community investment institutions practicing ESG integration (i.e., applying ESG criteria in their investment analysis and portfolio selection).[7]

· The amount of professional money managed using all three ESG criteria now represents 33% of the $51.4 trillion in total US assets under management.[8]

· The S&P 500 ESG Index exhibited excess returns performance of 2.68% against the benchmark S&P 500 Index. The main drivers of the outperformance of 2.68% was a combination of allocation effect (+0.46%) and selection effect (+2.23%).[9] When asked how important an alternative manager’s internal ESG policy is when deciding whether to make an investment, (i.e., that which guides the company’s policies/procedures), 70% of investors surveyed in the EY 2020 Global Alternative Fund Survey stated “Critically important”, up from 27% in 2019.[10]

· The number of ESG-themed strategies has skyrocketed over recent years. There were almost 400 ESG strategies launched in the Morningstar investment universe in 2019, compared with around 160 launches in 2016. Strategy size as analysed by Opimas found that the overall average size of ESG funds is now approximately $250 million AUM, with varied sizes by region with an average $400 million US strategy AUM, average $270 million in Europe and $70 million in Asia.[11]

Market Challenges

Its notable growth does not mean that ESG investing is without obstacles. In addition to investors’ demand for more ESG products and alternative managers not staying in step with that demand, they are increasingly considering a managers’ internal ESG policies as a critical due diligence criterion when making an investment decision. In fact, the number of investors citing this criterion as important has more than doubled from 2019 to 2020 with 70% of investors noting that it had a “significant impact” on their decision.[14]

Another factor challenging the growth of ESG investing is the lack of data transparency on a global scale. Disclosure of key data is not sufficient, but rather more data must be collected and shared to avoid environmental and social risks faced by our world and its economies. This effort will demand greater leadership, ingenuity, and collaboration with key stakeholders, as well as financial intermediaries, governments, industry organisations, researchers, and data scientists that can congregate relevant findings, analyse this data, and make logical deductions.

Also lacking and proving a challenge is the wide range of scoring methodologies being used by rating providers relative to what data should be analysed, how various metrics should be weighted, the materiality factor and its inclusion, and how missing data should be reflected. These diverging treatments, coupled with subjective views, has led to inconsistent data and widely varied ESG ratings, which is making it difficult for investors to compare ESG products. There is a concerted effort underway to improve ESG investment scoring, but there also remains a need to deliver a higher degree of consistency in ESG disclosure reports.

In its research on ESG investing, the Organisation for Economic Co-operation and Development (OECD) also found other challenges impeding sustainable investing. They include: a bias against small and middle sized enterprises (SMEs) by some providers wherein firms with higher market capitalisation and revenues receive higher ESG scores than those with very low market capitalisations; an inconsistent correlation between high ESG scores and returns, producing different results from different providers; and the effect of asset concentration related to tilting portfolios toward high-scoring ESG issuers on volatility, risk-adjusted returns and drawdown risk.[15]

Finally, many companies are still not leveraging digital platforms, instead relying on non-digital information which lacks in data scope and accuracy. ESG investing demands a high level of data aggregation and analysis which a non-digital process simply cannot achieve. Understanding and calculating the risk and return for ESG investments is challenging. Within the private market, no two assets are alike and therefore must be evaluated individually. This demands the highest level of data accuracy and transparency.

Market Opportunities

Research has shown ESG investments to be strong and resilient. The S&P 500 ESG Index demonstrated that with its low tracking error compared with the S&P 500 and its excess returns performance of +2.68 against the S&P 500 index benchmark.[16]

There is also the generation factor which further favours new opportunities in ESG investing. With the younger generations, Gens X, Y and Z placing a high value on cause-based and impact investing, they are more inclined toward ESG investments than previous generations. A deVere Group study of 1,125 millennials worldwide found that 77% place a high priority on socially responsible investments and impact investing.[17] With the Great Global Wealth Transfer expected to see $15.4 trillion be passed down by individuals with a net worth of $5 million or more by 2030 according to Wealth-X research,[18] ESG investments present an opportunity to capture new clients among these heirs.

Among the various asset classes, investors have the least confidence in hedge fund ESG investing because it involves negative screening leading investors to question how well risks have been vetted. This may be changing as more structured ESG frameworks, rating and scoring occurs giving hedge fund managers the ability to assuage investors’ concerns.

One area of ESG investing where all managers can improve, is in their diversity and inclusion (D&I) policies. Twenty six percent (26%) of private equity managers and 42% of hedge fund managers surveyed reported having no formal or informal D&I policy.[19] Developing sound internal policies will assist managers in attracting investors who view managers who prioritise D&I initiatives as being more likely to produce strong returns.

Through a standardised reporting framework, ESG investments data collection can be optimised, facilitating more advanced qualitative and quantitative data analyses. This will help alleviate any investor concerns over comparable data and enable them to make more confident ESG investment decisions.

Overall, ESG investing is an opportunity to reduce portfolio risk, while helping to address important global environmental, social and governance risks and requirements. It is also true that companies that place a high value on ESG issues are often those that take the long view and have corporate missions and visions that support fiscal stability and future viability. They recognise that planning for the future is critical for long-term performance. With this philosophy, ESG-oriented companies are attractive to sophisticated investors who see the merit in investing in these organisations. The data also supports the belief that ESG-focused companies have a better foundation for delivering higher financial performance over competitors for whom ESG matters are not a high priority.

Bite Investments and Our ESG Product Suite

Together with our strategic partner Apex, Bite offers a world class private markets ESG Ratings & Advisory service that measures sustainability factors and the ethical impact of businesses.

We deliver our services through a robust digital solution that performs critical functions, including: ESG Health Check (Quantitative Data Overview), Carbon Footprint Assessment (Assess Climate Impact), ESG Invest Check (Align to Key ESG Regulations) and ESG Rating, Reporting & Benchmarking (Scoring and Reporting Data Set). Through our ESG Ratings & Advisory Services, investors gain greater insight into companies’ holistic performance as it relates to its management and mitigation of risks and long-term competitive advantage, climate change and where solutions are underway, purposeful corporate governance, and regulatory and fiduciary drivers impacting the ESG landscape.

Risk warning: Investment is restricted to professional, high net worth and sophisticated investors who can demonstrate that they have sufficient knowledge and experience to understand the risks of investing. Risks include the potential loss of capital and limited liquidity. Investments are long term and it may not be possible to sell your investment prior to maturity. Past returns are not a reliable indicator of future performance.

Disclaimer: All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, Bite Investments. The facts of this fact sheet are believed to be correct at the time of publication but cannot be guaranteed. Please note that the findings, conclusions and recommendations that Bite Investments delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such, Bite Investments, can accept no liability whatsoever for actions taken based on any information that may subsequently prove to be incorrect. This document has been prepared purely for information purposes, and nothing in this report should be construed as an offer, or the solicitation of an offer, to buy or sell any security, product, service or investment.

1 CFA Institute, Principles for Responsible Investment, “ESG Integration in Asia Pacific: Markets, Practices, and Data,” July 2019

2 EY, “2020 Global Alternative Fund Survey”, November 2020

3 EY, “2020 Global Alternative Fund Survey”, November 2020

4 OECD, “ESG Investing: Practices, Progress and Challenges” September 2020

5 Goldman Sachs, “Alternative Perspectives”, December 2020

6 McKinsey, “Five Ways that ESG Creates Value,” November 2019

7 US SIF Foundation, “Report on US Sustainable and Impact Investing Trends 2020”, November 2020

8 MarketWatch, “ESG investing now accounts for one-third of total US assets under management,” November 2020

9 SPDJI Presentation: S&P ESG Index Series and SPDJI Index Scores, Q2 2020 (via CME Group, “Why ESG is Outperforming the S&P 500”), June 2020

10 EY, “2020 Global Alternative Fund Survey”, November 2020

11 Pensions & Investments, “Global ESG-data driven assets hit $40.5 trillion,” Sophie Baker, July 2020

12 US SIF Foundation, “Report on US Sustainable and Impact Investing Trends 2020”, November 2020

13 Morningstar, “Which Countries Lead on ESG?”, Valerio Baselli, April 2021

14 EY, “2020 Global Alternative Fund Survey”, November 2020

15 OECD, “ESG Investing: Practices, Progress and Challenges”, September 2020

16 SPDJI Presentation: S&P ESG Index Series and SPDJI Index Scores, Q2 2020 (via CME Group, “Why ESG is Outperforming the S&P 500”), June 2020

17 International Investment, “Survey finds three quarters of millennial prioritise responsible investing”, January 2020

18 Wealth-X, “A Generational Shift: Family Wealth Transfer Report 2019”, June 2019

19 EY, “2020 Global Alternative Fund Survey”, November 2020

20 US SIF Foundation data through 2018; Deloitte Center for Financial Services through 2025 (via Deloitte Insights “Advancing environmental, social, and governance investing”), February 2020