A ‘Bite’ of Private Markets – delivering Facts, Insights & Strategies

Private Credit in the Spotlight

Sean P. Clifford

Head of Business Development

Overview

Private credit is gaining much attention today and has become the third largest asset class across the private capital markets. It is providing much needed capital to finance privately owned businesses, an opportunity set that traditional bank lenders have largely retreated from, while also driving greater returns and new opportunities for investors.

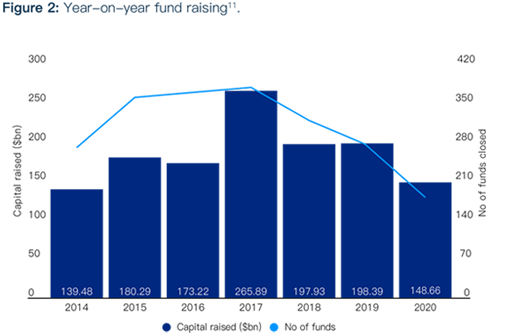

Despite the impact of the global pandemic on the private credit sector particularly the pullback of high-yield debt and syndicated loan providers during the first quarter of 2020, the number of private debt funds has grown steadily over the past decade along with investor confidence in this asset class [1].

The appeal of private credit has grown stronger in parallel to traditional banks’ greater hesitancy to lend to smaller or riskier borrowers. Corporate borrowers in the small-to-middle markets also are attracted to private credit for the more flexible terms it offers, along with longer maturity periods and shorter timelines. Private debt transactions can generate higher interest rates for lenders and investors. For example, the private credit market offers all-in yields of 7%-9% versus 4%-6% yields on public high yield bonds [2].

Institutional investors see private credit investments as an effective way to achieve greater diversification and reduce portfolio volatility. This was reflected in a Blackrock survey of 185 family offices globally which found that 23% of the family offices plan to make material changes to their private debt asset allocation, primarily due to having a long-term investment horizon [3]. Further, two-thirds of the family offices surveyed noted plans to increase their exposure to private debt due to the potential returns.

Behind the Numbers

- Data provider Preqin has predicted a 73% increase in private credit, with assets, hitting $1.46tn by 2025 [4] as investor demand for alternative, income-generating investments continues to expand.

- Out of the largest 200 U.S. retirement plans, private credit assets nearly doubled, up 93.1% to $50.2 billion in the year ended Sept. 30 2020 [5].

- Preqin reported that there were 592 private debt funds on the market seeking a combined $300bn [6] andprivate credit managers expect to lend over $100bn to SMEs and mid-sized businesses during 2020 [7].

- Statistics from 2020 also show that private debt fundraising was led by North America with $43.4bn, followed closely by Europe with $42.9bn. In comparison, the Asia-Pacific region raised $5.4bn. with the rest of the world raising $0.6bn [8].

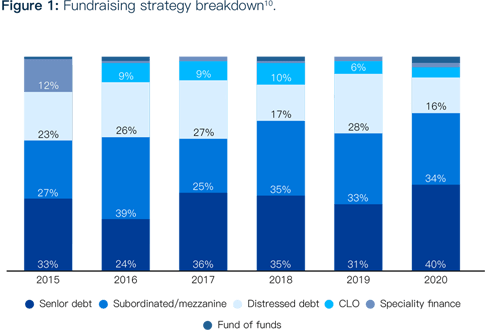

- In 2020, senior debt made up 40%of all capital raised by private debt funds whereas distressed fundraising made up only 16 percent of the total. Senior debt funds that closed in 2020 averaged over $1bn each for the first time since 2008 [9]. The attraction to senior debt can be derived from its relatively lower risk profile due to being at the top of the capital structure.

Market Challenges

Despite the growth in private credit as a decades-long trend[12], private credit is not without its challenges. There are perception problems with some believing it to be no more than private lending. Additionally, while institutional investors are increasingly gravitating towards it, their allocations in private credit are significantly below publicly traded asset classes. Building greater awareness of private credit and how it performs among institutional investors, as well as wealth managers and other trusted advisors, is still needed.

For high-net-worth investors (HNWI), private credit has historically been difficult to access. As a result, they turned to their private banks for private credit. That wall, however, is coming down as new alternative investment resources are opening up new opportunities to access private credit for HNW investors.

In light of the global pandemic and the amount of global stimulus money infused into various national economies, there is some concern as to what happens when the stimulus funds are gone. Will there be enough credit? This is likely to lead to greater volatility and related challenges. Also related to the pandemic is the concern over potential defaults. Credit managers, in dialogues with borrowers, which include many private equity firms’ portfolio companies, are discussing restructuring of loans and covenant waivers, forbearances and other measures intended to prevent defaults.

Covid-19 also has ushered in liquidity challenges, along with making it difficult to assess the impact of long-term credit investments on portfolios. This, coupled with dislocation of the public markets and delays in reporting has made it harder to establish valuations. Given that private credit is generally regarded as lower risk than equity and an alternative to certain corporate fixed income (e.g., high-yield notes and bonds), it is used strategically to defend against rising interest rates as well as for portfolio diversification.

Market Opportunities

Private equity firms have been leading the charge in private credit. They saw an opportunity and responded by raising huge funds to provide debt capital and have continued to play a prominent role in the asset class. They built partnerships across the continuum with funds, investors, advisors, and borrowers and steadily expanded their private credit fund offerings giving greater depth to this growing asset class.

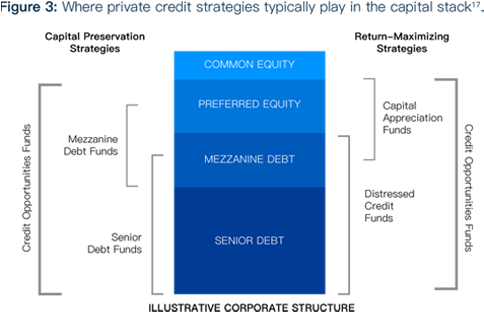

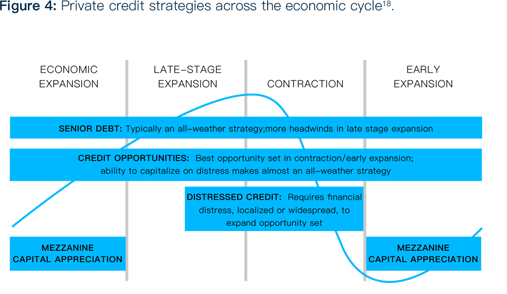

Private credit strategies can be classified as either capital preservation or return-maximizing strategies. Capital preservation strategies are similar to traditional sponsor-focused mezzanine and senior debt funds in that they seek to provide predictable returns while protecting against losses. Portfolios where capital preservation strategies are deployed are typically negatively skewed with both fewer losses and even fewer unexpected gains. Examples of capital preservation strategies include mezzanine and senior debt. Mezzanine traditionally refers to managers seeking to develop relationships with private equity sponsors and senior lenders to provide junior capital for financing buyouts or acquisitions. Senior debt funds (i.e., direct lenders) are closely aligned with traditional mezzanine lenders in their investment approach. These managers tend to pursue a sponsor coverage model by forging relationships with private equity managers to finance their buyouts and platform company expansions. Most of their returns are generated from coupons composed of a fixed credit spread and a fixed reference rate (often Libor).

When return-maximizing strategies are implemented, returns are closer to those of private equity and typically achieved through the purchase of stressed or distressed credit instruments. This is a strategy well-known to institutional investors who frequently purchased discounted loans or bonds with the goal of a par refinancing or a return-enhancing negotiated settlement. To achieve asset-level returns that are greater than traditional mezzanine, distressed corporate credit managers often target middle-to-large-capitalization companies and purchase deeply discounted debt securities. They look to generate returns through negotiations using whatever leverage they have as creditors under the governing document and bankruptcy code, as well as try to improve asset prices by noting upcoming refinancing or economic changes. A smaller percentage of these managers act in a “pull-to-par” investor manner and base returns on how they view a company’s fundamental valuation.

Despite challenging market conditions, the private debt sector has held up well with Preqin projecting a 73% increase in private credit with assets reaching $1.46tn by 2025 distinguishing it as the second-fastest growing alternative investment following private equity [13]. One reason is that it continues to offer investors new opportunities for generating returns ranging from the mid-single digits to over 20% [14]. Private credit also offers portfolio flexibility in that it can exist in various parts of a portfolio.

For example, where strategies are deployed for greater projected upside (e.g., distressed credit or capital appreciation), private credit can reside within private equity allocations. Where a lesser return is expected (e.g., mezzanine), it can be allocated to more opportunistic groups, and other forms of private credit such as senior debt can exist as a standalone asset class. In short, private credit accommodates diverse strategies ranging in size and scale, from specialty finance managers who invest in royalties raising $400 million funds to senior debt managers who target corporate borrowers with $40 million to $200 million in EBITDA and raise funds up to several billion dollars [15].

The opportunities afforded by private credit have not been lost on institutional investors who recognize its potential to offer many significant benefits. These include: the ability to structure transactions to provide risk-adjusted returns and yields through allocations in different portions of the capital structure, attractive returns, low relative volatility, low correlation to public debt and equity, and structural protection to withstand certain economic cycles [16].

Notes: Illustration does not take into account relative value across credit, or relative value between credit and other asset classes. Specialty finance strategies will have different experiences during the credit cycle depending on the type of asset in which they are invested. Committing to draw-down strategies requires a longer investment horizon than investing in open-ended strategies that allow for immediate capital deployment and regular liquidity.

Leveraging Alternative Investments

For institutional investors, family offices and HNW investors, alternative investments such as private credit offer opportunities best captured with the support of experienced fund managers, along with a skilled team of professionals leveraging sound investment processes, advanced digital technologies, and innovative business models that alleviate obstacles and help capture optimum opportunities.

Private credit presents multiple options for capital preservation and return maximization at that same time that it effectively addresses the needs of growing small and middle market businesses which, in turn, drives job and economic growth.

Risk warning: Investment is restricted to professional, high net worth and sophisticated investors who can demonstrate that they have sufficient knowledge and experience to understand the risks of investing. Risks include the potential loss of capital and limited liquidity. Investments are long term and it may not be possible to sell your investment prior to maturity. Past returns are not a reliable indicator of future performance.

Disclaimer: All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, Bite Investments. The facts of this fact sheet are believed to be correct at the time of publication but cannot be guaranteed. Please note that the findings, conclusions and recommendations that Bite Investments delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such, Bite Investments, can accept no liability whatsoever for actions taken based on any information that may subsequently prove to be incorrect. This document has been prepared purely for information purposes, and nothing in this report should be construed as an offer, or the solicitation of an offer, to buy or sell any security, product, service or investment.

1 IQEQ Insight: “The rise of private credit: who, what, where and why” Roxane Combe, 29 July 2020

2 IQEQ Insight: “The rise of private credit: who, what, where and why” Roxane Combe, 29 July 2020

3 BlackRock: Global Family Office Survey, Juniper Place, “Inside View” (accessed May 2021)

4 Citywire Selector, “Private credit funds resilient but the jury still out,” Selin Bucak, 26 November 2020

5 Pensions & Investments: Asset owners turn to private credit in quest for returns (accessed May 2021)

6 Preqin Quarterly Update: Private Debt, Q1 2021 (accessed May 2021)

7 Alternative Credit Council and Allen & Overy: “Financing the Economy 2020” (accessed May 2021)

8 Private Debt Investor Fundraising Report 2020 (accessed May 2021)

9 Private Debt Investor Fundraising Report 2020 (accessed May 2021)

10 Private Debt Investor Fundraising Report 2020 (accessed May 2021)

11 Private Debt Investor Fundraising Report 2020 (accessed May 2021)

12 BIS Quarterly Review, March 2020, Private credit: recent developments and long-term trends

13 Citywire Selector, “Private credit funds resilient but the jury still out,” Selin Bucak, 26 November 2020

14 Cambridge Associates, LLC, Private Credit Strategies: An Introduction (accessed May 2021)

15 Cambridge Associates, LLC, Private Credit Strategies: An Introduction (accessed May 2021)

16 Barings, published in Benefits and Pensions Monitor, “5 Things to Consider When Investing in Private Credit,” Ian Fowler, October 2018

17 Cambridge Associates LLC, Private Credit Strategies: An Introduction (accessed May 2021)

18 Cambridge Associates LLC, Private Credit Strategies: An Introduction (accessed May 2021)

Bite Fact Sheet Private Credit in the Spotlight