In our annual review of the private markets, we are looking at how investor preferences are shaping the strategies and operations of investment managers to stay ahead of their competition and build long-lasting relationships with valued investors.

2025 has been anything but dull for those involved in the private markets. From swooping global tariffs implemented by the Trump administration changing the rules of global trade to continued international conflicts causing regional instability, investors (LPs) and investment managers (GPs) have encountered their fair share of turbulence as we end the year. In this article, we are taking a deep dive into the evolving expectations of LPs and, in turn, how savvy GPs are adapting to attract and retain the best investors.

Fundraising in 2025

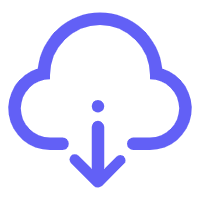

Due to the wider macroeconomic factors at play mentioned above, it’s been a challenging year so far for fundraising in the private markets. To emphasize this point, the mid-year review from Bain & Company[1] makes for a compelling read; Figure 1 below highlights how there has been considerably less capital raised over the last 12 months than previous years. While challenging, we believe this period represents an important time for GPs. Yes, fundraising in 2025 has been tough but firms can use this time productively, utilizing the necessary time to build strong relations with new LPs and keep existing investors updated and engaged.

Figure 1: Global private capital raised, by type ($B)

Notes: Includes closed-end and commingled funds only; buyout category includes buyout, balanced, co-investment, and co-investment multi-manager fund types; includes funds with final close and represents the year in which they held their final close; excludes SoftBank Vision Fund; other category includes fund of funds, mezzanine, natural resources, and others; data as of May 16, 2025

Sources: Preqin, a part of BlackRock; Bain analysis

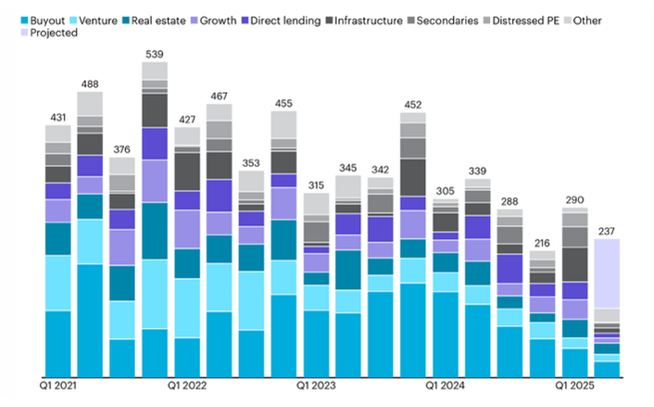

Interestingly, as we can see from Figure 2 below, private equity exits in Europe have rebounded strongly in Q3 as markets stabilized after a tough Q2[2]. We see that exit volumes increased by 22.6% and if we continue to see this positive trend, exit activity is on track to achieve YoY growth, which looked highly unlikely only a matter of months ago.

Figure 2: Exits, PE exit by quarter

Source: Pitchbook, Geography: Europe, As of 20 September 2025

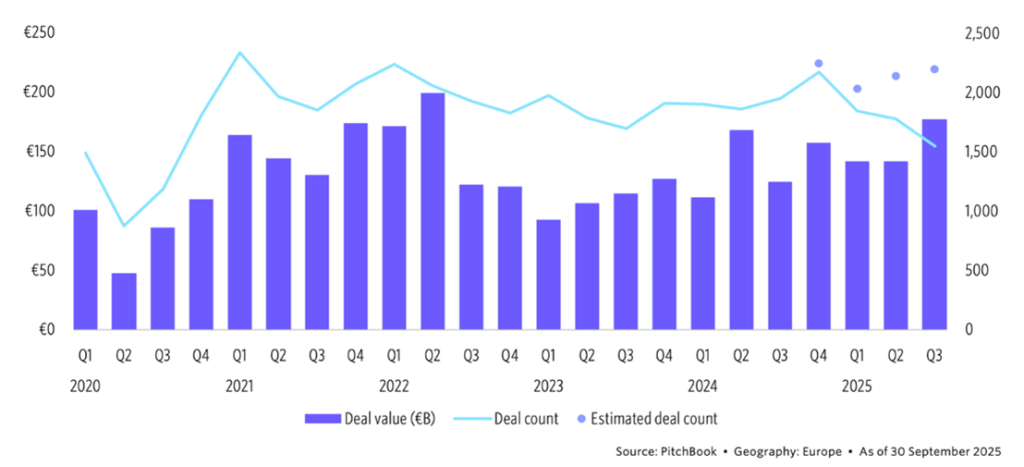

The uptick in exit activity fits with a widely shared view from investors of a preference for firms to speed up exit processes, even if that means exiting portfolio companies at a lower valuation than previous years. Figure 3 shows how investors have become frustrated with partial or minority exits and would prefer firms to focus on executing conventional exits to improve liquidity. 63% of investors surveyed would even prefer firms to do this even at a lower multiple than previous returns[3]. While this bodes well for fundraising efforts next year with investors seemingly focused on gaining access to fresh capital to hopefully re-invest, GPs should also focus on providing flexible solutions which could provide their LPs with liquidity today.

“The uptick in exit activity fits with a widely shared view from investors of a preference for firms to speed up exit processes, even if that means exiting portfolio companies at a lower valuation than previous years.”

Figure 3: LPs want more conventional exits, even at valuations below recent marks

Source: ILPA-Bain webinar poll, March 2025

What everyone wants… liquidity

As mentioned above, there is a general consensus that both investment managers and investors are searching for improved liquidity as we approach 2026. GPs require exits to start returning capital to increasingly impatient investors, and in turn, those LPs need liquidity to diversify their portfolios and back new funds of new or existing GPs.

LPs are even increasingly turning to legacy assets (funds at least a decade old) to manufacture liquidity from their private equity portfolios[4]. Due to a lack of distributions, investors are offloading ‘tail-end funds’ on the secondary market which explains the booming secondary market highlighted in Figure 1.

This willingness to create liquidity should be good news for fundraising in the private markets in 2026. However, it won’t be a free lunch for all; only the savviest of GPs will capitalize in this crowded fundraising marketplace – they should take note of evolving LP expectations below.

GPs striving for operational improvements

A recent report from CSC, which surveyed 150 LPs in C-suite roles across the UK, North America, Europe and Asia Pacific found the top 3 priorities of LPs are “operational transparency, regulatory compliance and technology infrastructure” with an increasing focus on fund accounting, investor reporting, regulatory findings, cash management and compliance monitoring[5]. Furthermore, the report found that LPs are today increasingly likely to view operational infrastructure of GPs as a direct extension of their fiduciary responsibility. It’s no surprise then that a staggering 85% of LPs reporting poor fund administration has negatively influenced investment decisions.

Prudent GPs will therefore be wise to thoroughly assess operations; they should review their investors’ journey, highlighting areas of over complexity and work towards making the process a more simplified, smooth investor journey. Above all, they will ensure their operations are not only compliant today but provide the flexibility to meet the needs of a diverse range of global LP compliance requirements.

“Prudent GPs will therefore be wise to thoroughly assess operations; they should review their invertors’ journey.”

A desire for less complexity and more transparency

The private markets have seen an influx of new investor entrants over the last few years with technology playing a key role in lowering the traditionally high bar of entry for many HNWs and retail investors. As opposed to being a playground for the more established institutional investors, individual investors are now welcome.

It’s no surprise that for these new entrants, the complexity found within the less-transparent world of private markets is often a stumbling block. According to the recent Global Wealth Study 2025 from the Thinking Ahead Institute, 46% of wealth managers who took part in the study said they ‘largely or entirely’ outsource private markets allocations due to the complexity encountered, demonstrating a preference to use third party experts. This is in comparison to just 27% for listed bonds and 23% equities[6].

Furthermore, with 68 percent of LPs surveyed in the CSC report stating they are focusing on operational transparency, private markets should strive to reduce complexity and enhance transparency to attract a new breed of investors. These LPs will be more open to new technology solutions to help navigate traditionally complex operations encountered throughout the private markets.

Lastly, high GP fees are also cited as a concern for some LPs. According to the Global Wealth Study 2025 report, the two major potential barriers to increased investing of private market assets are fees and a lack of transparency. The good news is that GPs are already innovating fee structures to be more transparent. A key report for the private credit industry from the Alternative Credit Council (ACC), the private credit affiliate of the Alternative Investment Management Association (AIMA), and City law firm[7] Dechert, found that two-thirds of survey respondents are using tiered management fee schedules and have plans in place to continue innovating fee models with new technology solutions in response to the fiercely competitive fundraising environment.

“Private markets should strive to reduce complexity and enhance transparency to attract a new breed of investors.”

Spotlight on data savvy, tech-focused GPs

In a recent interview with EQT, Hugh MacArthur, Chairman of Bain & Company’s Global Private Equity Practice, predicted that a quarter of capital flowing into private equity over the next decade will come from individual investors with retail money very much predicted to be a staple of the private markets for years to come[8]. To cater to this growing influx of individual investors, MacArthur noted that firms must prioritise investing in technology to keep up with demand.

This aligns with the CSC report cited earlier which found LPs believe technology is a major differentiator when looking at competitor GPs. They expect technology that offers real-time data access, integrated systems, automated reporting, and strong cybersecurity.

Following a similar trend, Private Equity International’s 2024 fundraising report found that 35% of survey respondents should demonstrate ‘advanced digital analytics and reporting’ with only ‘deep sector and subsector expertise’ (43%) and ‘individual portfolio manager experience’ (38%) higher on the list of GP priorities[9].

There’s no doubt that technology should form an integral part the investor relations journey but choosing the right solution will be the biggest challenge as GPs strive to understand which technology will be the most effective, smooth and adaptable for their existing LP base.

Conclusion

Based on the findings of this report, LPs will continue to expect an improved level of service from their GPs, regardless of market conditions. As Eran Fabian, Bite Stream Managing Director noted at the Aztec Private Market Leaders Summit, returns help in good times, but they do not guarantee loyalty when markets turn. What keeps LPs from walking away is trust built early through clear communication, robust due diligence and proper education. In more difficult periods, that trust and partnership become critical.

As we move towards year-end, we envisage savvy GPs striving to build more trust with their existing LP base. Crucially, this means taking the time to refine operations and invest in the right technology to provide the instantaneous, transparent and compliant-ready communications LPs will be expecting in 2026 and beyond.

Sources

[1] Bain & Company, Leaning Into the Turbulence: Private Equity Midyear Report 2025, June 2025

[2] Pitchbook, European PE Breakdown, October 2025

[3] Bain & Company, Leaning Into the Turbulence: Private Equity Midyear Report 2025, June 2025

[4] Mergermarket, Tail-end secondaries surge as LPs step-up pursuit of liquidity in PE portfolios, September 2025

[5] CSC, The Limited Partner’s Guide to Fund Operations, November 2025

[6] Investment Week, Private market allocations forecast to stagnate due to high fees, October 2025

[7] FundsEurope, Private credit driven by investor demand for liquidity, customisation, rated notes and co-investment, October 2025

[8] EQT, Hugh MacArthur: Individual Investors Are Powering Private Markets – and Forcing Firms to Adapt, September 2025

[9] Adam Streets Partners, 2025 Global Investor Survey: Navigating Private Markets, March 2025

Disclaimer: This article is made available by BITE Investments (UK) Limited (“Bite UK”), a company incorporated in the United Kingdom (company registration number 11706620) with its registered office at 28 Ecclestone Square, London SW1V 1NZ. The information contained in this article (the “Information”) is for informational purposes only and may not be relied upon for the purposes of evaluating the merits of investing in any shares, other securities, limited partnership interests or other interests in any funds listed or referred to in the article or for any other purpose. The Information does not constitute an offer to acquire any limited partnership interests, shares or other securities, make any investment or to provide any fund management services or any investment advice of any kind, nor does this article constitute an invitation to invest, directly or indirectly, in any company or collective investment scheme, or to undertake to do so. Reliance on the Information for the purpose of engaging in any investment activity may expose the investor to a significant risk of losing all of the money invested. Nothing in this article is to be construed, and shall not be relied upon as, legal, regulatory, credit, business, tax or accountancy advice. The Information may change and there shall be no obligation on the part of Bite UK to update any of the Information. Data and facts used in this article are derived from sources which are considered to be reliable and have been compiled using Bite UK’s best knowledge. However, Bite UK does not guarantee the correctness of the Information. This article and the Information are strictly confidential and are used exclusively for a limited number of addresses. Reproduction of this article or the dissemination of this article, or the Information, to third parties, is not permitted.

Learn more about how Bite Stream can help you

Discover a solution that suits your needs